There are a lot of moving pieces when it comes to retirement, particularly on the income side of the equation. And one of the biggest involves Social Security. The social safety net often provides plenty of much-needed income for retirees. However, it can be difficult to decide when exactly to take payments.

Deciding to take Social Security too early could have a lasting effect on the total amount of income you’ll receive from the program over your life. The flipside is that many Americans need those funds as soon as possible.

This is where a fixed annuity could come in. Thanks to their guarantees and ability to generate lifetime income, investors have the ability to use them to help maximize Social Security, while still receiving the income they need without the market risk.

Fixed Annuity Basics

There are plenty of different annuity products out there, but one of the more interesting and potentially beneficial ones for retirees/pre-retirees could be the humble fixed annuity. Like all annuities, these are contracts between an individual and an insurance company. The beauty is that fixed annuities offer opportunities for the accumulation and decumulation phases of retirement.

As the name suggests, fixed annuities offer ‘fixed’ returns for the term/length of the contract. Here, the issuing insurance company is willing to pay the investor a guaranteed and fixed rate of return for a certain period of time. So, investors can lock-in a guaranteed 4% to 5% annually for five or 10 years. At the end of the contract term, investors can either take the money, reinvest it in another fixed annuity or begin lifetime income payments.

While that may sound like owning a bond or CD, fixed annuities have a few benefits over these classic income products. For one thing, they can’t lose money because of the guarantees. The Bloomberg U.S. Aggregate Bond Index’s negative 13% return in 2022 reminded investors that bonds don’t have such guarantees. Second, unlike CDs—whose interest is taxed every year—fixed annuities and their crediting interest are tax-deferred and are only taxed when investors withdraw funds from the account. And because of how annuities work, not all payments/withdrawals from an annuity are considered taxable.

Because of these benefits, fixed annuities make for ideal bond/CD replacements within a fixed income sleeve.

Fixed Annuity Coupled With Social Security

Fixed income annuities have another big win when it comes to Social Security as well: they function as a bridge to delay payments.

For savers, there are three numbers when it comes to Social Security:- 62, 65 or 67, and 70. Those are the age bands for the program’s payouts. Savers can start taking Social Security at age 62. However, by doing so, their payouts for the rest of their lives are reduced. At 65—or 67 for younger workers—investors get their ‘full benefits.’ However, delaying payments as long as they can till 70 increases the program’s rewards. For many people, this is advantageous.

The problem is many people can’t wait that long. Either illness, unemployment or any litany of reasons causes most people to begin payments at 62.

This is where a fixed annuity can help.

Pre-retirees can take a portion of their savings ahead of retirement and place it into a fixed annuity. This removes a portion of their savings from market risk, earning a guaranteed return for the crediting years. Rather than take Social Security at 62 or 65, they can then annuitize the fixed annuity and start receiving monthly income payments. Then they can delay Social Security until their overall payment is larger.

It turns out this is a wonderful strategy to increase long-term income. According to investment manager BlackRock and the Bipartisan Policy Center, adding a fixed annuity can significantly boost retirement income over the long haul.

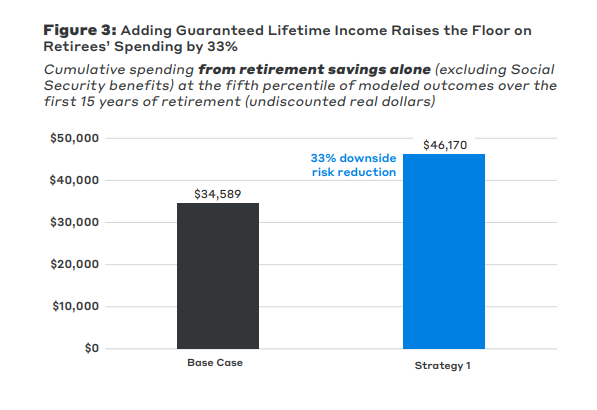

Running over 100,000 different simulations, the pair found that by adding a fixed annuity, the spending floor can increase income by as much as 33%. For example, the average retirement saver in America is a 35-year-old with an annual income of $44,000, a 5% savings rate, a 50/50 split of stocks/income, and a current retirement account balance of $19,000. By delaying Social Security and adding a fixed income, insurance-backed annuity, this worker would add more than 29% spending power versus someone taking Social Security at 65 and not buying the annuity. 1

This chart from the duo’s “Paving the Way to Optimized Retirement Income” report highlights the increase in spending floor and minimization of downside risk to income. By avoiding market risk and locking-in income, investors are able to have more. In the scenario above, that’s about 33% more downside risk reduction.

Source: Bipartisan Policy Center

Using the Strategy

As you can see, a fixed annuity can serve a variety of investors in a variety of phases of retirement planning. Younger investors can use a fixed annuity to reduce bond/stock volatility to then allow for larger Social Security payments later in life. Those in preretirement can use it as a near-term bridge to delay payments as well. Meanwhile, those in retirement can use it to delay Social Security by reducing risk, and then annuitize payments. Ultimately, Social Security can provide a huge income floor for those in retirement. Making sure savers optimize that floor is a paramount issue. By using a fixed annuity, they can do just that.

For savers and advisors, the key points to remember come down to costs and fees, as well as crediting rates. All annuities have surrender charges for ending the contract early, as well as annual fees. Keeping these as low as possible helps keep more of an investor’s money in their pockets. Second, the highest interest rate may not be the best deal for a portfolio depending on the strength of the issuer or potential lifetime income options. While the days of smarmy sales people, extremely high fees, and other traps still exist, many top insurance companies offer low-cost and easy-to-understand annuity products.

It pays to shop around and investigate before hitting the purchase button.

Fixed Deferred Annuity Providers

These issuers were selected based on their issuer rating, which ranges from A to A++. The lowest minimum investment required ranges from $5,000 to $25,000.

| Insurer | AM Best Rating | Lowest Minimum Investment |

|---|---|---|

| New York Life | A++ | $5000 |

| TIAA | A++ | $5000 |

| Prudential | A+ | $5000 |

| Nationwide | A+ | $10000 |

| Pacific Life | A+ | $25000 |

| Lincoln Financial | A | $10000 |

The Bottom Line

Getting Social Security right is a tough nut to crack, with many potential pitfalls. Delaying is the best strategy for most investors. A fixed annuity can provide a bridge needed to optimize Social Security withdrawals in retirement. By using one, investors can lock-in more lifetime income and create an income floor to boost outcomes.

1 Bipartisan Policy Center (June 2023). Paving the Way to Optimized Retirement Income