The Setting Every Community Up for Retirement Enhancement or SECURE Act 2.0 has a lot of provisions that have excited the financial planning community. From new rules on 529 Plans to charitable giving, the law is a smorgasbord of ways investors can boost their savings into their golden years.

But some of the most exciting developments are being ignored.

The whole point of the SECURE Act 2.0 was designed to boost retirement security for everyone. That includes many underserved workers. Under the law, financial advisors have plenty of new tools to help these workers meet their retirement dreams.

Scary Statistics

As we check social media, read financial blogs, and tune into CNBC, it’s easy to forget that a lot of Americans aren’t in the same boat as what the media would have you believe. Looking at the American workforce, the vast bulk of Americans work for smaller companies that don’t offer retirement savings; are self-employed or are small-business owners; work just part-time; or live paycheck to paycheck.

More than 57 million Americans have no option to save for retirement at work.

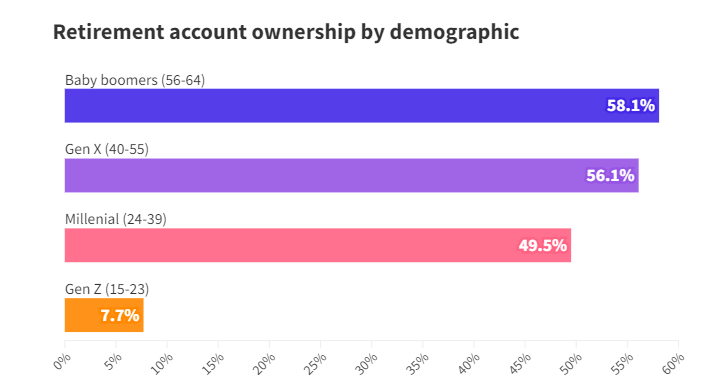

The numbers of Americans with retirement savings at all is pretty bleak as well. According to the last Census data, less than one-half of working age Americans have any retirement savings. Even Baby Boomers aren’t immune. One in four have no retirement savings and just over one-half have some.

This chart from the Hill shows the breakdown of retirement savings account access by age cohort.

Source: The Hill

It’s this savings crisis and access to retirement savings that spurred Congress into action with the original SECURE Act and the additional provisions in the latest version of the law.

Plenty of Retirement Saving Options for Employees

A lot of pundit focus for the SECURE Act has zoned in on items like the new 529 Plan rollover potential, required minimum distributions (RMDs) changes, and higher catch-up provisions. And it’s true that many of these items will affect and change the retirement landscape for many investors and workers. However, some of the provisions in the SECURE 2.0 could be life changing for lower income workers or those without retirement plan access.

Here are five ways the Act can be beneficial to select groups of employees.

1. Automatic Enrollment & Portability

For those workers with access to retirement plans, the SECURE Act 2.0 features some automatic benefits. One problem is that participation in a 401k or similar plan is optional. For those on the lower end of the wage scale, often the decision to not participate is made. Under the legislation, businesses adopting new retirement plans will automatically enroll eligible employees at a rate of 3% in 2025. To help them start those plans, the SECURE Act offers small and medium-sized businesses plenty of tax credits and incentives.

Perhaps better than saving that money is keeping it. Right now, many plans have small balance cash-outs when a worker changes jobs. Rather than roll it over, many Americans spend this money. Under the SECURE Act , smaller balances will be transferred to an employee’s new plan when they change jobs, effectively keeping that money for retirement.

2. Saver's Match

401ks are great in that an employer will often provide a matching contribution. However, for those without workplace retirement plans and those using IRAs, all of their savings must come from their own pockets. Beginning in 2027, the Act replaces the nonrefundable Saver’s Credit for some IRA and retirement plan contributions with a new Federal Savings Match. One-half of IRA or workplace retirement contributions—up to $2,000—will be deposited into a saver’s IRA or retirement plan. Income limits and phase-outs do apply. However, for many workers, this provides a real opportunity to save and get the needed match.

3. Part-Time Workers Get a Boost

Part-time workers will also get the chance to participate in retirement savings accounts. Under the current law, employees with at least 1,000 hours of service in a 12-month period or 500 service hours in three consecutive years must be allowed to join workplace retirement plans. The SECURE Act 2.0 reduces the three-year period to just two years. This would jumpstart younger workers’ savings and enable those with extra part-time jobs to save earlier.

4. Emergency Savings Accounts

Another major issue is that many low-income workers don’t have any emergency savings. The SECURE Act fixes that issue as well. Workplace retirement plans can now offer an emergency savings account starting 2024 that functions as a Roth, meaning it’s tax-free. Non-highly compensated employees are able to contribute up to $2,500 annually, with the first four withdrawals in a year being tax- and penalty-free. Depending on plan rules, contributions may be eligible for an employer match, as well.

5. Student Loan Relief

Finally, student loan relief is on the docket as well. Starting next year, those borrowers with student loans may get ‘match’ payments into retirement accounts by employers for their monthly payments. This could help increase education/workplace training initiatives as well as help borrowers save for retirement. High payments and large student loan burdens are often seen as a major cause for younger workers to skip retirement savings contributions.

The Bottom Line

The SECURE Act 2.0 was a treasure trove of wonderful ways for Americans to boost retirement savings and investments. This includes plenty of ways for lower-income and non-retirement account holders to save. In many instances, these new additions could be lifesavers and financial planners should be made aware of all the options available for this underserved class.