Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This year’s recap of trends revolves around the best-performing stocks for 2017. Amazon led one of the biggest trends when it bought Whole Foods. Defense stocks like Northrop Grumman had a great year, thanks to turmoil with North Korea. With Hurricanes Harvey, Irma and Maria, Home Depot benefited due to the damage to millions of homes. Apple had a great year with the successful releases of several products, most notably the iPhone X. Finally, financials was one of the best-performing sectors, thanks to low interest rates and a favorable tax plan.

You can view our previous Trends article here, which revolved around CVS planning to buy Aetna, Bank of America announcing a buyback, TD Bank missing earnings, and rumors of Disney buying 21st Century Fox.

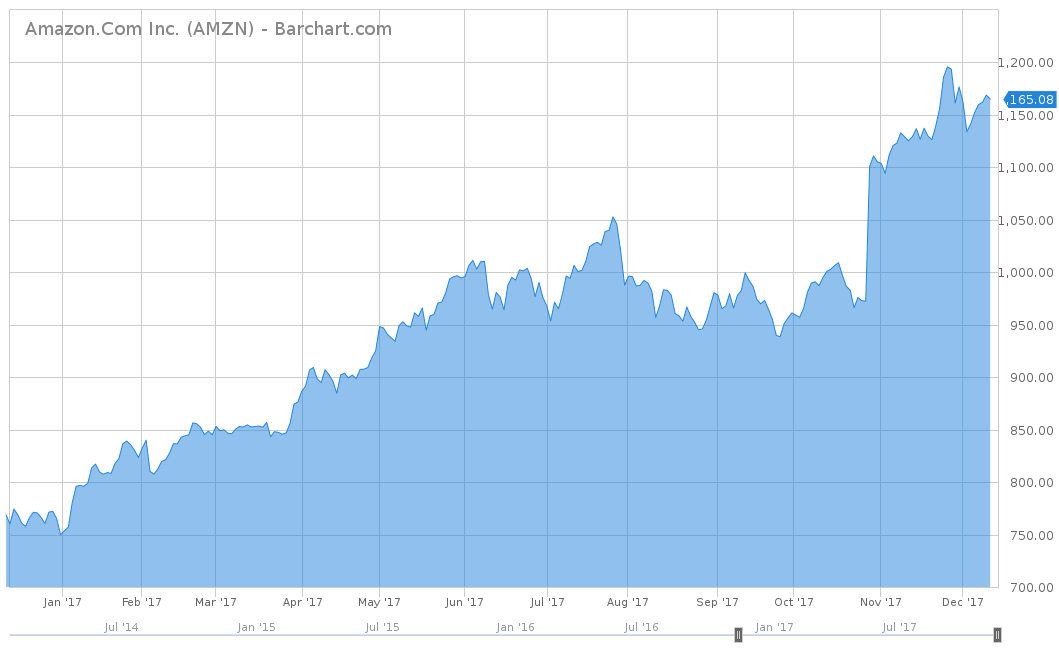

Amazon Buys Whole Foods

Amazon Inc. (AMZN) was one of the year’s top-performing stocks and one of the most trending topics when it was announced that the e-commerce giant was buying the grocery chain, Whole Foods Markets, in June. The news saw a 377% increase in interest, as Amazon decided to take Wal-Mart Inc. (WMT ) head on in the grocery business. The $13.7 billion deal was completed in late August of this year. While the merging of the two stores is still in process, Whole Foods stores have begun selling Amazon Echo and Dot devices to begin the integration of the two brands. There are also noticeable markdowns on bananas, eggs, apples, meat and other consumable goods. In the future, Amazon will also integrate its Prime features to give Prime customers special savings and other in-store benefits when they visit a Whole Foods.

Over the last five days, Amazon stock is up 2.06%, and up 55.37% on a year-to-date basis. On a long-term basis, the stock has been outstanding with a total return of 362.77% over the trailing five years. Today, the stock is trading near its all-time high above the $1,200 per share mark. Amazon does not currently pay a dividend, while Whole Foods stock no longer trades.

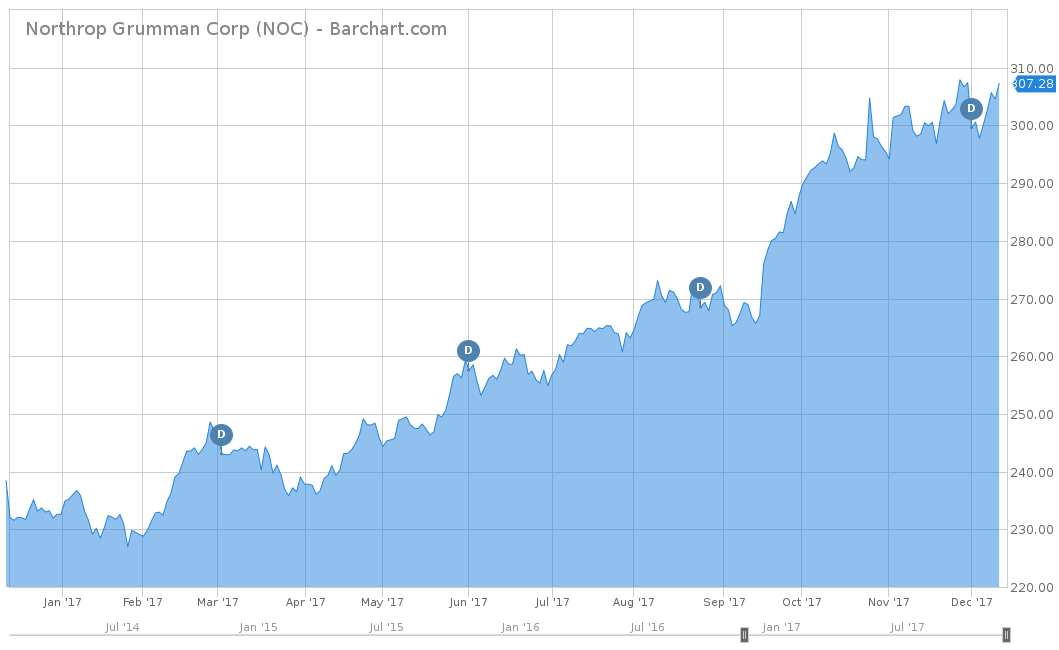

Defense Stocks Skyrocket

Back in August, tensions were high between the United States and North Korea, causing defense stocks to skyrocket. Both President Donald Trump and North Korea’s Kim Jong-un were exchanging threats about North Korea successfully testing a nuclear missile. Although the threat is still imminent and tensions remain between the two leaders, the only ones to benefit are defense companies like Lockheed Martin Corp. (LMT ), Northrop Grumman Corp. (NOC ) and Raytheon Corp. Liquid error: internal. All three stocks are currently trading near their all-time highs.

Over the past five days, the best performing of the three stocks is Northrop Grumman, which is up 3.20%. On a year-to-date basis (as of December 12), the stock is also the best performer, up 32.12%, although LMT and RTN have also performed well, up 26.39% and 31.61%, respectively. Northrop Grumman currently pays a dividend of $4.00 per share, which is equal to a 1.30% yield. NOC has also shown an excellent history of growing its dividend, raising it every year since 2008. It also raised its dividend in June by 11%, up from $3.60 per share.

To view all aerospace & defense dividend stocks, click here.

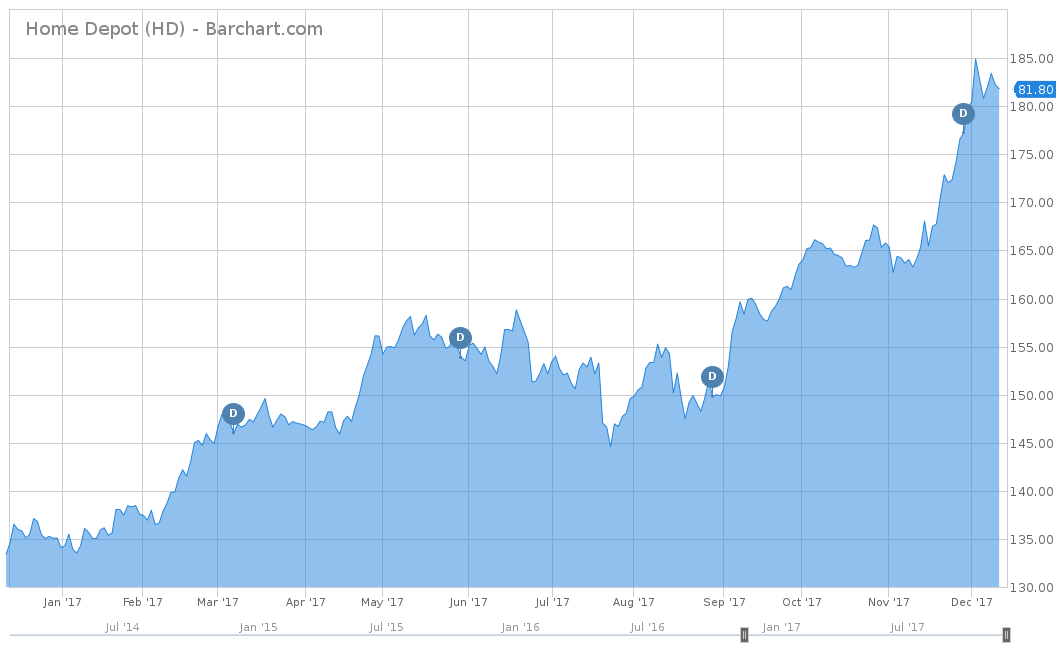

Three Hurricanes Hit U.S. in 2017

Throughout the course of the year, three hurricanes hit the United States and Puerto Rico, costing billions of dollars in damage and leaving many places throughout the nation in devastation. First, Hurricane Harvey hit in August, ripping through Texas and Louisiana. Then Hurricane Irma hit a few weeks later, leaving Florida and Georgia in a wake of destruction. Finally, Hurricane Maria left Puerto Rico in a total blackout of power and supplies. Although these hurricanes destroyed many lives and left parts of the country in shambles, a few companies like Home Depot Inc. (HD ) benefited from the tragedies because of the sudden surge in demand for building materials.

Over the last week, Home Depot is down 0.57% but the stock is up 35.59% on a year-to-date basis (as of December 12). For the last three months, HD is actually up 13.69%, which is around the same time period of all the hurricanes hitting the country. Over the last five years, Home Depot has been an excellent investment and is up 188.89%. This is more than double the return of the S&P 500 Index, which is up 86.50% for the same time. Home Depot also pays its investors a dividend of $3.56 per share, equal to 1.96%. It also has established a recent history of growing its dividend, with four consecutive years of growth.

For the best home improvement stores that pay a dividend, click here.

Apple Releases iPhone 8, 8 Plus and X

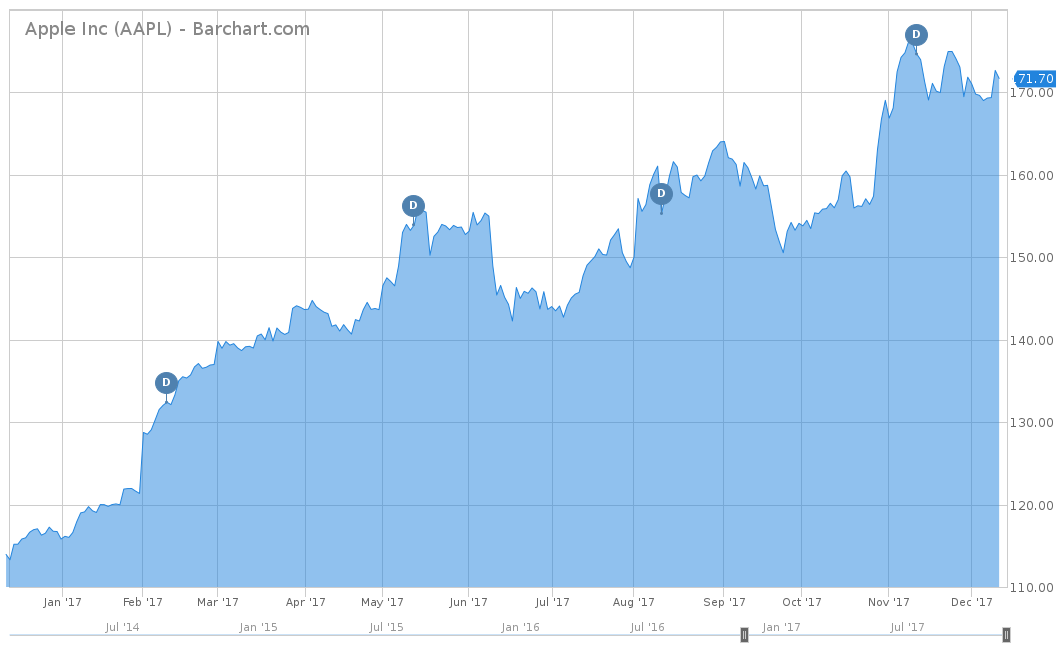

The largest company in the world by market capitalization continues to be the tech giant, Apple Inc. (AAPL ), which had another landmark year in 2017. The company announced earlier this year the release of several new products, like the iPhone 8, iPhone 8 Plus, iPhone X, the Apple Watch Series 3 and Apple TV 4K. The most notable announcement has been the release of the iPhone X, which marks the 10-year anniversary of the iPhone. Although the iPhone X has a hefty price of $999, demand continues to be very high as the country enters the holiday season.

Apple continues to be one of the best-performing stocks in 2017, and is up 1.21% for the last week. On a year-to-date basis (as of December 12), Apple is up 48.25% and trading a few dollars off its 52-week high. Over the last five years, the stock has also performed better than the S&P 500 with a total return of 122.99%. Apple also differentiates itself by being one of the few technology companies that pays a dividend. The stock pays its investors an annual amount of $2.52 per share, which is equal to 1.47%.

Financials Continue to Rally in 2017

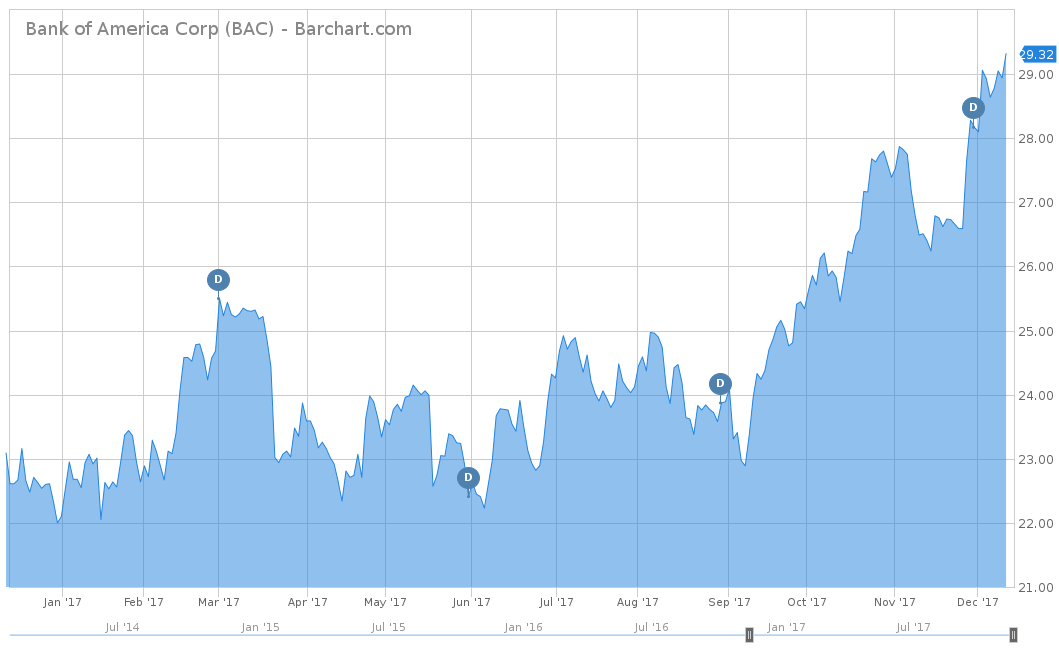

One of the best performing sectors for the year has been financial stocks, thanks to low interest rates, a strong economy and the recently adopted corporate tax plan. One of the best performers for the year has been Bank of America Corp. (BAC ), which saw a big boost in July when the Federal Reserve passed all 34 banks during its annual financial stress test. This is the first time since 2008 that all 34 passed, signifying the financial sector is back on strong footing. As a result, Bank of America announced several buybacks this year and the legendary Warren Buffett exercised over $17 billion in warrants to buy the bank.

Over the last week, Bank of America has traded up 1.35%. On a year-to-date basis, it has also performed very well and is up 32.67%. The company has also seen a growing trend since its bottom in 2008, with the stock increasing 176.34% for the trailing five years. The stock currently has a dividend yield of 1.64%, which pays an annual amount of $0.48 per share. Although the stock has rebounded over the last five years, the company has only raised its dividend in the last three. However, if the tax bill gets passed and interest rates remain relatively low, expect Bank of America and other financial stocks to profit.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

Amazon is up 55% on a year-to-date basis after outstanding earnings, and it made the news through acquisitions like Whole Foods. Defense stocks rose this year as both President Trump and Kim Jong-un continue to make threats about North Korea’s nuclear missile testing. With an increase in demand for building materials, Home Depot increased after three hurricanes hit the country. Apple was trending this year after releasing its iPhone 8, 8 Plus and X models. Finally, financial stocks have had a great 2017 with a low interest rate environment, paired with all 34 banks passing the Fed’s annual stress test for the first time since 2008.

For more Dividend.com news and analysis, subscribe to our free newsletter.