Before the opening bell today, beverage giant Coca-Cola (KO ) reported its fourth quarter results. And while Buffett’s stock pick managed to beat analyst estimates, the company’s results were less than impressive.

Coca-Cola Faces Headwinds

In Q4, Coca-Cola posted net income of $770 million, down roughly 50% from last year’s $1.71 billion figure. Revenues also came in lower, falling 2% from last year’s $11.04 billion to $10.87 billion. The company, however, noted the U.S. dollar’s strength greatly impacted foreign sales; Coca-Cola estimated that without currency fluctuations, earnings would have come in at 44 cents per share.

For the most part, North American sales helped buoy the company’s revenue in the quarter, even though consumption of soft drink products on a volume basis has declined or remained flat over the last three quarters. In other parts of the world, Coke sales were less than impressive for the quarter:

- European volumes slipped 1%

- Asian volumes grew only 1%

- Japanese volumes fell 1%

- Chinese volumes decreased by 3%

- Latin American volumes grew by 2%

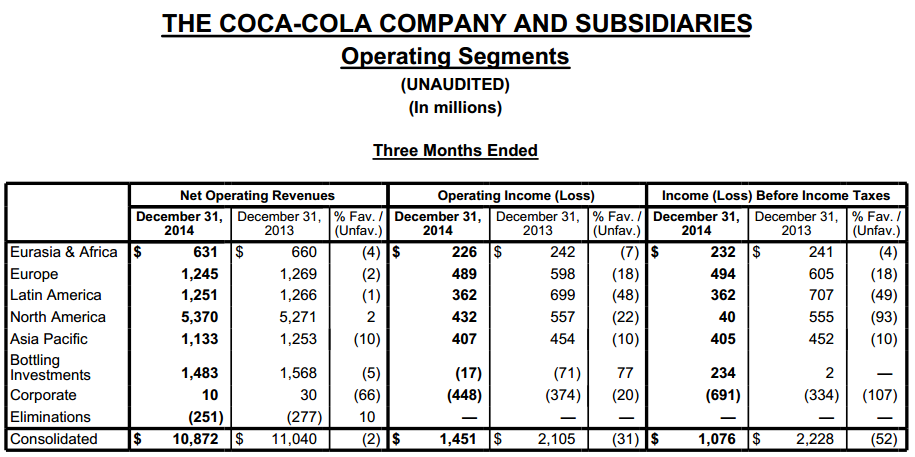

Below is a breakdown of the company’s revenue and income by operating segments:

A "Transitional" Outlook

These disappointing global results, combined with the industry-wide trend of declining sugary soda sales due to health concerns, have created significant headwinds for Coca-Cola.

In its earnings report, CEO Muhtar Kent warned shareholdings of an upcoming “transitional period.” In the next year or so, Kent stated that the company will be focused on accelerating growth, but the success of this strategy will likely be hampered by the “volatile macroeconomic environment.” Currency fluctuation against a strong greenback is one of the macroeconomic issues the company believes will negatively impact foreign sales.

During the call, Kent also noted the following net impacts of structural items on full-year 2015 results:

- A slight positive on net revenue growth

- A 1 to 2 point headwind on gross profit growth

- A 1 point headwind on operating income growth

- A slight headwind on profit before tax growth

Be sure to also check out Coca Cola Company Vs. Bottlers: A Dividend Comparison.

The Bottom Line

While Coca-Cola has always been a favorite for long-term investors—especially considering its 52-year track record of increasing dividends—the company is obviously headed toward some kind of transitional period, caused primarily by industry trends. We will keep a close eye on this company, looking to see if Coca-Cola perhaps shifts its focus toward new markets, such as healthy alternatives to soda.

Be sure to follow us on Twitter @Dividenddotcom