In today’s global market, it is difficult to find a company that only focuses on a single line of products or services. Add to that the high level of merger and acquisition activity seen in recent years, and investors may be surprised to see how vast and diversified a company’s product or service lineup is.

In this piece, we take a look at nine well-known mega-corporations, each of which has a significant presence in their respective industries. They are often referred to as companies that own the world, given their wide reach. A closer look at each company’s businesses reveals that these firms own a vast majority of the most popular brands and businesses.

Unilever

Unilever (UL ) is one of the largest consumer goods manufacturers in the world. Its product lineup is also one of the most diversified; the company sells everything from soap to olive oil. Some of its major brands include: Dove, Axe, Lipton, Ben & Jerry’s, Vaseline, Knorr, Bertolli, Wall’s Ice Cream, Hellmann’s, Pond’s, Tresemme, St. Ives, and Slimfast.

Unilever’s products are sold in over 190 countries, and according to the company’s annual report, roughly 2 billion customers worldwide use Unilver products on any given day. Those stats put Unilever in an elite group of companies that own the most brands across the globe.

PepsiCo

Though best known for its iconic Pepsi soda, PepsiCo (PEP ) has expanded past its soft drink roots, offering some of the most popular snack food brands. The company’s top snacks include Doritos, Cheetos, Tostitos, Fritos, Lay’s, Ruffles, Stacy’s, Sabra, and muller [see also 12 Companies Paying Reliable Monthly Dividends].

Pepsi has also expanded its beverage lineup, which includes Mountain Dew, Gatorade, Tropicana, 7up, Lipton (through a joint venture with Unilever), Naked Juice, Aquafina, and select bottled Starbucks products.

Coca-Cola Co.

The Coca-Cola Company (KO ) is also known for its iconic lineup of soda – Coca-Cola and Diet Coke. Over the years, the company has expanded into other beverage lines, featuring brands like Sprite, Fanta, Dasani, Fresca, TaB, Powerade, and VitaminWater.

Coca-Cola also offers a line of healthier drink options including Simply Orange, Minute Maid, Odwalla, Fuze, Honest Tea and Zico.

Anheuser-Busch InBev

Anheuser-Busch In Bev (BUD ) is one of the largest brewers in the world with a lineup of more than 200 beer brands. The company’s three global brands are Budweiser, Corona, and Stella Artois. Its international brands include Becks, Leffe, and Hoegaarden [see also The Unofficial Dividend.com Guide To Being An Investor].

ABInBev also has an impressive lineup of local brews, including Brahma, Chernigivske, Jupiler, Skol, Labatt, and St. Pauli Girl.

Procter & Gamble

Procter & Gamble (PG ) is by far one of the largest and most established consumer products companies. P&G is best known for its lineup of household cleaning products, including: Charmin, Bounce, Tide, Febreze, Cascade, Downy, Mr. Clean, and Bounty.

The company also sells some well-known beauty and healthcare products including Pantene haircare, Olay, CoverGirl, Old Spice, Gillette, Crest, and Oral-B.

According to P&G, 25 of its brands generate more than $1 billion in annual sales; of its vast product lineup, 50 brands represent more than 90% of the company’s sales and profits.

Kraft

Kraft Foods Group (KRFT) is one of the largest food and beverage companies in North America. For its beverage lineup, Kraft brands include Maxwell House, MiO, Crystal Light, Tassimo, CapriSun, Kool-Aid, Gevalia, and Country Time.

Kraft also owns the brands A.1., Athenos, Breakstones, Cheez Whiz, Claussen, Cracker Barrel, Jell-o, Lunchables, Miracle Whip, Oscar Mayer, Philadelphia, Planters, Polly O, and Velveeta.

The J.M. Smucker Company

The J.M. Smucker Company (SJM ) is best known for its iconic fruit spreads. Today, however, the company makes a lot more than fruit jam. A closer look at the company’s SEC filing shows that the company’s biggest operating segment is actually its retail coffee. The company’s coffee brands include the iconic Folgers, Cafe Bustelo, Dunkin’ Donuts’ retail packaged coffee, kava, Medaglia Doro, Milstone, and Pilon [see also The Unofficial History of Warren Buffett].

The company also owns the popular brands Jif, Pilsbury, Eagle Brand, Crisco, Hungry Jack, Magnolia, Martha White, and truRoots.

Darden Restaurants

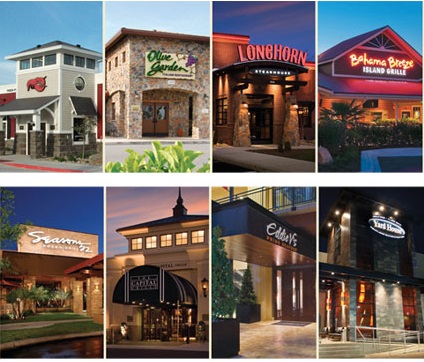

While Darden Restaurants’ (DRI ) portfolio may not be as impressive as some of the other companies on this list, the firm does own some of the largest casual dining restaurants in the U.S. and Canada.

Darden’s family of restaurants include Olive Garden, LongHorn Steakhouse, Bahama Breeze, Seasons 52, The Capital Grille, Eddie V’s and Yard House. Through the company’s subsidiaries, Darden owns and operates more than 2,1000 restaurants, which serve more than 425 million meals a year.

Comcast Corporation

After several high-profile mergers and acquisitions, Comcast Corporation (CCV ) is now one of the largest media companies in the world. The company is split up into two major businesses: Comcast Cable and NBCUniversal. The Cable segment provides personal and business solutions for TV, internet, and communications.

NBCUniversal is even more impressive, since its presense in the U.S. media industry is a substantial one. The company owns several cable networks including Bravo, Chiller, E!, MSNBC, NBC Sports, Oxygen, Syfy, and the Weather Channel. NBC also owns Fandango, Hulu, iVillage. On the filmed entertainment side, the company owns Universal Pictures and Focus Features. Last, but not lease, the portfolio also includes Universal Parks & Resorts and Universal Studios Hollywood.

Investing in Single Product Companies

One of the fundamental pillars of a successful investment strategy over the long haul is diversification. Seasoned professionals always preach about the importance of maintaining a well-balanced portfolio of securities, and for good reason too: spreading out your exposure across sectors, market caps, and even geographies is a surefire way to mitigate some of your risk while still having “skin in the game.”

It may seem a bit counterintuitive, but there is actually good reason to consider investing in companies that are not very diversified. That is to say, finding companies that derive the majority of their revenues from one kind of product or a particular service [see also Best Global Brands That Pay Dividends].

The appeal behind investing in these so-called “one trick ponies” is actually very straightforward; because these firms are focused on just one product, investors can more accurately pinpoint the underlying price drivers and thereby have a clearer sense of where the stock might be headed.

Think about this: it’s much harder to isolate, understand, and gauge the potential headwinds and catalysts for a company with a vast product lineup compared to a firm that predominantly focuses on a single line of business. Likewise, these single-product companies also bear more risk; the simplicity of their business models is also their greatest source of risk, seeing as how one negative development in their particular sector can have a devastating effect on the entire company.

Below we take a look under the hood of five dividend-paying, single-product companies:

WD-40 Co. (WDFC )

Anyone who has ever had to get their hands dirty in the garage or their local hardware store has likely come across WD-40, the iconic lubricant. Originally named the “Rocket Chemical Company,” today the firm boasts a global reach and its product lineup spans beyond the famous “Water Displacement on the 40th try” formula, or WD-40 for short. Nonetheless, the company remains focused on selling lubricants; according to the latest annual SEC report, WD-40 had two product lines, multi-purpose maintenance products and homecare & cleaning products, of which the former accounted for over 80% of total sales.

Clorox Co. (CLX )

If you don’t know the Clorox brand then you need to help out more with cleaning chores around the house. This 100-year old consumer goods company is known for a variety of household brands in addition to the famous Clorox bleach, including: Pine-Sol cleaner, Fresh Step cat litter, Glad trash bags, Hidden Valley salad dressings, Brita water filters, and Kingsford charcoal among many others. According to the latest annual SEC filing, revenues from the liquid bleach product alone accounted for approximately 14% of total sales.

Scotts Miracle-Gro Co. (SMG )

This company has been selling lawn seed since 1868 and today it has grown into a behemoth, boasting easily one of the most recognizable brands in the lawn and garden market. In addition to selling Miracle-Gro brand fertilizer, Scotts boasts a handful of other recognizable brands, including: Roundup weed control, Tomcat rodent control, Ortho pest control, and Earthgro mulch. According to the latest annual SEC filing, the company has two operating segments, Global Consumer and Scotts LawnService; the former of these segments includes the well-known lawn and garden product lineup and accounted for nearly 90% of total sales [see also 25 Financial Advisor Blogs Actually Worth Reading].

Tootsie Roll (TR )

This Chicago-based candy maker has been around since 1896 and its flagship product then, the Tootsie Roll, remains one of the most iconic sweets on the market today. The company boasts a variety of other recognizable products from the candy aisle in addition to the Tootsie Roll, including: Frooties, Dots, Charms Blow Pops, as well as Junior Mints. In its most recent annual SEC filing, the company notes that “sales normally maintain a consistent level throughout the year except for a substantial increase in the third quarter which reflects pre-Halloween and back-to-school sales,” and while this is by no means surprising, it does emphasize the fact that single-product companies are for the most part impacted by fewer factors compared to companies that operate in several different industries.

Nutrisystem Inc. (NTRI)

Founded originally in 1972, Nutrisystem has evolved from selling weight loss counseling and products in brick and mortar locations to a direct-to-consumer model. Today, the company sells its products online, on TV, over the phone, and even in big-box retailers; its offerings include a combination of ready-to-go food, fresh-frozen menu items, as well as its well-known weight management program. According to the latest annual SEC filing, revenue consists primarily of food sales and “is strongest in the first calendar quarter and lowest in the fourth calendar quarter,” which goes to showcase the seasonal nature of many single-product companies [learn about Dividend Dates here].

Companies That Don’t Do What You Think They Do

The old adage “don’t judge a book by its cover” holds quite a bit of weight on Wall Street as any seasoned market veteran will warn you of reaching conclusions about investment opportunities without even having opened the book so to say. Plain and simple, one of the fundamental pillars of having a a successful investment track record over the long-haul is being diligent.

Doing some good ole fashioned research and digging through SEC filings can help you get an edge by avoiding one of the pitfalls that many younger investors fall into; that is, being overconfident and pulling the trigger too early on a company they didn’t really investigate [see Free Lunch on Wall Street: 21 Ways Investors Can Make (and Keep) More Money].

As with many things in life, looks can be deceiving, and stocks are no different. Below we highlight five well-known dividend payers that are associated with iconic products, but in reality, they actually derive a bulk of their revenues from other lines of business. Here are some of the most popular companies that do not do what you may think they do:

IBM Corp. (IBM )

Commonly referred to as “Big Blue,” IBM went on to introduce a number of inventions throughout the 20th century that revolutionized our everyday lives, and one of the most memorable ones was the IBM 5150; this was among the first “personal computers,” and it quickly became the industry standard, earning IBM the reputation as a “PC company.” According to the most recent annual SEC filing, however, it’s apparent that IBM is no longer the so-called “computer company” despite many investors’ first thoughts when they stumble across the stock [see IBM’s Best Day Ever].

In 2013, global technology services, which includes providing IT infrastructure and business process services, accounted for 38% of total revenues; even the second biggest operating segment isn’t related to computer hardware, it’s consulting and application management services, and accounts for 18% of total revenues.

General Electric (GE )

This company has been around for well over 100 years and, given its ties with the great inventor Thomas Edison, it’s no wonder that many still think of it as an electric company of some sort. This couldn’t be further from the truth today, as GE has evolved into a diversified behemoth that has a lot more to do with financing than it does with electricity. According to its 2013 annual SEC filing, the company’s biggest operating segment, GE Capital, which provides financial services globally, accounted for 30% of total revenues. Some may be surprised to learn just how diversified the company is, boasting a presence in everything from the energy and aviation markets to healthcare and transportation, among others.

Xerox (XRX )

Xerox was founded in 1906 and soon thereafter it earned the reputation as “the copy machine company” after debuting the Xerox 914; this was the first plain paper photocopier and its instant success re-ignited momentum for the company, which had struggled with a slow and costly research and development process in the years prior. Fast forward to today, and not surprisingly Xerox doesn’t really make its money from selling photocopy machines anymore. According to its 2013 annual SEC filing, the company’s biggest revenue source was its services segment, accounting for 55% of total revenues; this includes administrative, management, and technology services for major industries and government agencies around the globe.

The J.M. Smucker Company (SJM )

The company behind the iconic American fruit spreads has been in business since 1897 and the “Smucker’s” brand remains one of the most recognizable food brands. Today, the company makes a lot more than fruit jam, however, which might be surprising for many investors who are quick to connect it with only its most iconic product. According to its most recent annual SEC filing, the company’s biggest operating segment was retail coffee, which accounted for 39% of total revenues. Although many associate Smucker’s with fruit jams and JIF brand peanut butter, the company is also behind the Folgers brand, which has become a staple in kitchens across America.

Here is a quick list of every stock mentioned above. Click on the ticker to learn more about each company:

| Learn More About these Stocks |

|---|

| WD-40 (WDFC ) |

| Clorox Co. (CLX ) |

| Scotts Miracle-Gro Co. (SMG ) |

| Tootsie Roll (TR ) |

| Nutrisystem (NTRI) |

| Unilever (UL ) |

| PepsiCo (PEP ) |

| Coca-Cola Co. (KO ) |

| Anheuser-Busch InBev (BUD ) |

| Procter & Gamble (PG ) |

| Kraft (KRFT) |

| The J.M. Smucker Company (SJM ) |

| Darden Restaurants (DRI ) |

| Comcast Corporation (CCV ) |

| IBM Corp. (IBM ) |

| General Electric (GE ) |

| Xerox (XRX ) |

| Newell Rubbermaid (NWL ) |

The Bottom Line

While diversification can be beneficial to any business strategy, it is important for investors to realize just how strong some of these mega corporation’s grasp is on their respective industries.

Be sure to follow us on Twitter @Dividenddotcom