Investors have been piling into cash and T-bills with much aplomb over the last year or so. With the Fed raising rates to combat inflation, the shorter end of the curve is now paying very juicy yields. These days, investors can get nearly 5% without much risk at all.

Or, is there actually risk behind those juicy short-term yields?

Reinvestment risk has once again come to roost in the bond world. And as the Fed begins to slow its path of tightening, pause, and even potentially cut in the near future, investors in cash and other short-term assets may be putting themselves at so-called reinvestment risk. With that, investors may want to rethink their current bond holdings.

The Hidden & Ignored Risk

The last year has been unprecedented for bond investors. After skirting zero percent for roughly a decade, the Federal Reserve has managed to boost benchmark interest rates to more than 5.25% in a very short amount of time. As such, the entire bond world has been in flux. For savers, this has been a boon. Short-term bonds, cash and T-bills have quickly gone from being parking places for funds to becoming an asset class, worthy of portfolio allocation.

After all, why not get 5% in ultra-safe assets? The “not” comes down to so-called reinvestment risk.

Reinvestment risk looks at the cash flow of a bond and the income it throws off. Investors generally turn to bonds for that steady coupon payment. Remember these are “fixed income” investments. Reinvestment risk looks at what to do with the proceeds of a bond after it matures.

This risk increases – i.e., investors receive lower income – in falling rate environments. Short-term bonds start paying less as the Fed cuts, while longer-termed bonds come to market with yields much lower. Existing longer-termed bonds rise in price to match the current yield of new issues, reducing the income they throw off for investors looking to buy them.

June Could be the Start

While no one except the Fed governors really knows what their plans are, data suggests the Fed may be closer to the end of its tightening cycle than starting it. Already, inflation seems to have been broken, falling from rates not seen since the 1980s down to just 3.2% today. At the same time, various economic indicators are slowing as well. From housing and consumer spending to labor and manufacturing, data has started to show a maturing economy – albeit, still growing, just at a steady pace.

With that, the Fed may be starting to think about taking its foot off the gas. Already, we saw it pause in June and the recent pace of hikes has just 0.25% at a time.

According to asset manager John Hancock, this puts reinvestment risk on the table again for bond investors. While those in short-term bonds and cash may think they are doing the right thing, they could end up short end of the stick when the Fed moves. That’s because the market is pretty effective at sensing and predicting the Fed’s actions. Historical data shows potential underperformance short-term bond holders could see if they don’t act soon.

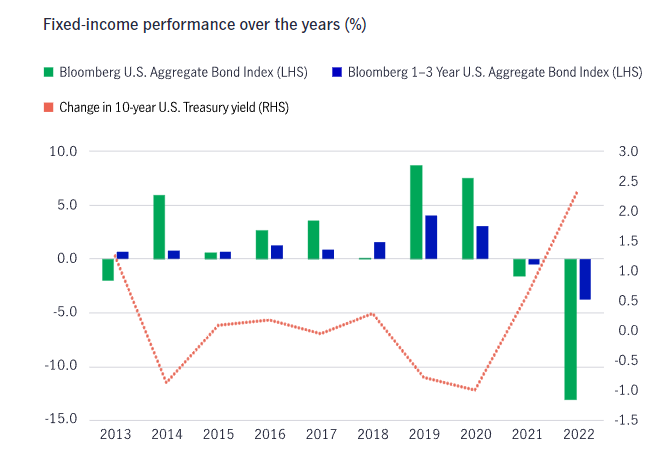

Source: John Hancock

As you can see from this chart, longer-termed bonds clearly outperform shorter ones in falling rate environments. Moreover, the chart indicates that the Fed often pauses and keeps rates slowly growing before cutting rates – just like we’re seeing today.

Go Longer to Lock In Income

With the recent pause and current data, John Hancock suggests that reinvestment risk is growing for bond and income seekers. In that, investors should actively look to lock in yields and higher future income today. While they may sacrifice some current yield, the long-term creates a higher income and total return picture. For investors, that means stepping out of T-bills/cash and buying intermediate- or, even, long-dated bonds.

The beauty is that doing so is very easy. Simply buying the iShares Core US Aggregate Bond ETF or Vanguard Total Bond Market Index Fund ETF is a simple way to add intermediate bonds, while the SPDR Portfolio Long-Term Treasury ETF or Vanguard Long-Term Bond Index Fund could be used for long-term bond exposure – two tickers, no fuss.

Intermediate and Long-Term Bond ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| STPL | BMO Global Consumer Staples Hedged to CAD Idx ETF | $6.88B | -3.8% | 0.03% | ETF | No |

| BND | Vanguard Total Bond Market Index Fund ETF | $95.36B | 0.2% | 0.03% | ETF | No |

| AGG | iShares Core US Aggregate Bond ETF | $93.89B | 0.2% | 0.03% | ETF | No |

| BLV | Vanguard Long-Term Bond Index Fund ETF | $5.65B | -1.3% | 0.04% | ETF | No |

However, according to John Hancock, there’s some nuisance here. Getting the balance between future income and removing reinvestment with the Fed’s plans could be a tough nut to crack for retail investors. Here, they suggest an active approach as a “more effective way for investors to gain exposure to intermediate duration bonds and take advantage of the current yield opportunity.”

Investors may want to look at the so-called core-plus category of bond funds. These allow bond managers a bit of freedom when it comes to durations and allocations within the investment-grade universe. As such, they could offer exposure to the right blend of short- and intermediate-term bonds in one package.

Core-Plus ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| UBND | VictoryShares Core Plus Int Bd ETF | $214.5M | 1.6% | 0.4% | ETF | Yes |

| JCPB | JPMorgan Core Plus Bond ETF | $1.282B | 1.2% | 0.39% | ETF | Yes |

| CGCP | Capital Group Core Plus Income ETF | $985.4M | 1% | 0.34% | ETF | Yes |

| BCOIX | Baird Core Plus Bond Fund Class Institutional | $23.693B | -0.4% | 0.3% | MF | Yes |

| JHBIX | John Hancock Bond Fund Class I | $5.878B | -1% | 0.47% | MF | Yes |

| LAPLX | Lord Abbett Core Plus Bond Fund Class A | $133.7M | -1.3% | 0.68% | MF | Yes |

The overarching lesson is that investors in cash and T-bills are facing risks that they may not have considered. Reinvestment risk could seriously hinder their income unless they act soon.

The Bottom Line

Cash and short-term bonds have proven to be very popular with investors. However, the future exposes many investors to reinvestment risk. Shorter-term bonds simply will not keep up with income, and unless they act soon, longer-term yield opportunities may be gone. For John Hancock, that means moving out on the duration now to lock in yields.