Truth be told, investors are facing a bit of a quandary. After last year’s drubbing and the current issues plaguing this year, the issue of where to invest and allocate capital is a difficult decision. There are pros and cons to a variety of asset classes, with some having bigger margins than others.

According to investment bank and wealth manager UBS, the answer is clear.

Bonds and other fixed income assets are a better choice than equities. Thanks to a variety of factors, bonds are the better choice when it comes to portfolios and investor allocations. Overweighting fixed income could be key to winning this year.

A Gloomy Equities Outlook Priced In

It’s no secret that the last few quarters has been a mixed bag for investors. Last year, both stocks and bonds fell as the Federal Reserve began its tightening environment and raised rates. However, since then, the markets have stabilized, minus a few shocks. In those gains and stabilization, UBS highlights that investors may have already priced in too much growth in equities.

Global stocks on the whole have been pretty resilient despite recent banking shocks and interest rate increases across the globe. However, with stocks now making new highs and re-entering a bull market, investors may be getting ahead of themselves. The reason comes down to earnings and the shaky economic picture.

As the Fed has tightened, recessionary forces have grown. Manufacturing output is lower, consumers are spending less, unemployment has risen, and credit is getting tighter. With that, corporate earnings should decline. According to UBS, first quarter earnings for the S&P 500 are predicted to decline by 1% to 3% year-over-year. That will be about a 3% to 5% beat versus consensus analysts’ expectations. 1

Looking ahead, UBS predicts a stormier picture. According to the wealth manager, many of the issues and recessionary risks will persist throughout the year. Overall, current consensus expectations are looking for 5% EPS growth in the second half of the year. UBS thinks that’s too high. Based on continued pressures and mounting recessionary forces—even if we don’t actually enter one―the bank predicts that EPS will decline by 5% in 2023.

This is particularly an issue when looking at forward P/Es. Right now, the S&P 500 trades for a forward P/E at around 18×. Looking at historical data, UBS shows that forward earnings growth expectations are normally in the mid-teens when the P/E is around that high.

As such, upside in the market seems very limited. And in fact, there might be a drop. UBS predicts that the S&P 500 will hit 3,800 by year end, which is about a negative 7% total return based on current levels. Even the bank’s bull case scenario only predicts a 7% total return from current levels.

Bonds Are Cheap

But the reverse is true when it comes to bonds. As the Fed tightened, bond prices fell. Overall, the Bloomberg U.S. Aggregate Bond Index fell by 13% in 2023. However, this year, unlike equities, bonds have continued to drift sideways. The Fed has continued with its pace of rate hikes. As such, investors haven’t fully moved into the asset class just yet. This has kept yields at highs not seen since 2008.

Moreover, given the current rising risks to the economy, the Fed may be closer to the end of its tightening cycle than not. Indeed, the Fed’s recent pause could be a signal that conditions are deteriorating enough. Given the overpriced nature of the equity market, bonds should be able to win on the total return front with yields alone driving gains. In fact, according to the bank, investment-grade corporate bond yields would have to rise above 60 bps for them to produce a negative total return for 2023.

Making a Bond Play

With stocks being expensive and the potential for poor returns for the rest of the year, investors may want to take UBS’s advice and overweight bonds. Overall, the bank suggests ‘quality’ over simply focusing on yield. Using a barbell strategy, holding short and long duration bonds could be the best way to win and allow investors to take average of current high yields and future capital gains. The UBS-sponsored UBS Multi Income Bond Fund follows the bank’s current guidance and could be used to play its advice.

The first spot investors should consider, according to UBS if they are going it alone, would be investment-grade corporate bonds. Here, investors have the best opportunity for yield and gains. The iShares Broad USD Investment Grade Corporate Bond ETF could be all you need. Investors looking to focus on quality may want to use the iShares Aaa – A Rated Corporate Bond ETF, which only owns the top-tier rated corporate bonds.

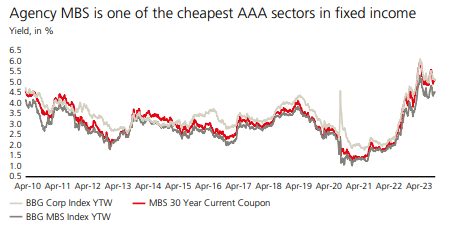

Another place to look? Mortgage-backed securities (MBS). According to UBS, MBS bonds represent one of the cheapest fixed income sectors. The following chart illustrates just how big yields for AAA-rated MBS bonds have gotten.

Source: UBS Wealth Management.

To that end, the Vanguard Mortgage-Backed Securities ETF is a fine choice for adding exposure. However, given the opportunities, active management could be better. The new DoubleLine Mortgage ETF and established PIMCO Mortgage-Backed Securities Fund are sponsored by two of the biggest and best bond-focused managers in the business.

Here's a summary of plays for UBS’ recommendations.

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| iShares Aaa - A Rated Corporate Bond ETF | QLTA | ETF | No | $881 million | 1.6% | 0.15% |

| iShares Broad USD Investment Grade Corporate Bond ETF | USIG | ETF | No | $9.04 billion | 1.3% | 4% |

| DoubleLine Mortgage ETF | DMBS | ETF | Yes | $99 million | 0.8% | 0.49% |

| PIMCO Mortgage-Backed Securities Fund | PTRIX | Mutual Fund | Yes | $172 million | 0.1% | 0.5% |

| UBS Multi Income Bond Fund | UTBAX | Mutual Fund | Yes | $28 million | 0.08% | 1.73% |

| Vanguard Mortgage-Backed Securities | VMBS | ETF | No | $15 billion | -0.2% | 0.04% |

The Bottom Line

With stocks already pricing in much growth, bonds are the better bet for investors. According to UBS, it would be smart to overweight fixed income with corporate bonds and MBS being top choices. Overall, bonds have the potential to deliver strong income and capital gains throughout the year.

1 UBS (May 2023). UBS House View