There is nothing like the safety of cold hard cash. Investors use cash for a variety of reasons in their portfolios, from a buffer to smooth out volatility to a strategic allocation for spending/income. For many portfolios, the main way investors allocate that cash is to money market funds. And with yields of nearly 5%, cash balances are sitting at record highs, reaching over $5.71 trillion to be exact.

Money market funds are not the same as a FDIC-protected bank deposit, a lesson many investors learned during the Great Recession.

However, our portfolios’ cash allocations may be getting a bit safer. Thanks to changes to critical rules, money market funds are getting more secure for investors. That means ‘breaking the buck’ could be a thing of the past.

A Share Price Failure

By definition, money market funds—which are not to be confused with money market bank accounts—invest in very short-term securities, sometimes having maturities as short as overnight. These can include Treasury bills, commercial paper, bankers’ acceptances, repurchase agreements, municipal on-demand notes, and certificates of deposit (CDs). There are numerous varieties of money market funds based on the underlying types of securities they own.

These funds have long served as that source of liquidity/savings for portfolios and are designed to provide stability of a stable $1 per share price.

That’s the theory anyway. But it doesn’t always work out. Generally, there is a very healthy market for commercial paper, repos, and other short-term assets. However, during times of extreme duress, liquidity becomes an issue. When there’s a stampede of investors seeking liquidity at the same time, money market funds are not able to sell their short-term investments. And in that, the value of the assets it holds drop by too much to keep a stable $1 share price.

This is known as breaking the buck and it’s happened twice now within the last decade. During the Great Recession, the Reserve Primary Fund—which was one of the largest prime money market funds around—could not redeem shareholder demands and fell below $1 per share. During the COVID-19 pandemic, liquidity dried up as investors ran for the exits in the commercial paper and repo market.

The SEC Steps In

To prevent these types of situations from occurring again in the future, the SEC adopted several rules for money market funds under the banner of code 2a-7. Initially, the regulatory body limited withdrawals from prime funds altogether.

A second round of rules enacted required that the NAV on prime funds—which own commercial paper and other non-government short-term assets—to float and be extended out to $1. This means prime funds can move below $1 if needed. Moreover, new rules allowed fund companies for gatekeeping of withdrawals across the money market fund spectrum to prevent future surges of investor demand and forced liquidation of assets.

The idea made money market funds safer.

But with the COVID-19 issues, the SEC went back to the well. With that, the governing body in a 3-2 vote just launched a series of additional improvements to money market funds.

For starters, the funds will be required to have additional liquidity requirements. Going forward, money market funds will be required to hold at least 25% of their total assets in daily liquid assets and at least 50% of their total assets in weekly liquid assets. This is up from 10% and 30%, respectively. 1

Second, money market funds will remove the gatekeeping that limits withdrawals. SEC research showed that the gates actually increased stress on the funds as investors would try to pull their cash out before the gates closed, exacerbating the issues.

Finally, the SEC has removed the ‘swing pricing’ mechanism and replaced it with mandatory liquidity fees for institutional prime and tax-exempt money market mutual funds. Here, funds will charge a fee of 1% on all redeeming shares when net redemptions are more than 5% of assets.

Safer, But Potentially Lower Yield

These proposals are designed to impact institutional money market funds and clients. But the goal is to help improve outcomes for regular Joes. Often, institutional and retail investors’ funds are commingled in the same money market fund and are separated via a different share class.

For example, the liquidity fees are designed to buoy a fund and help keep retail investors safe by preventing larger clients from ‘breaking the buck.’ Likewise, the removal of gatekeeping prevents the stampede of larger investors hurting retail clients.

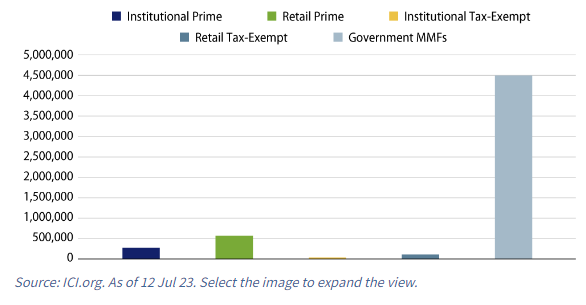

However, there may be one downside: prime funds may disappear and yields may not be as juicy as before. Thanks to the increased liquidity requirements, managers won’t be able to stretch for yield. That will increase the amount of cash in government securities, a trend that is already happening.

This chart from Western Asset highlights the sheer amount of cash already in government funds.

Source: Western Asset

The proposals make money market funds safer for everyone, which is a big win considering that the asset class is now representing a real strategic portfolio play.

The question is: What should investors do with their cash? Given the trends, betting solely on government and municipal money market funds makes a ton of sense. Ultimately, prime funds may not exist much longer or simply be the realm of institutional investors. That’s not too shabby at all considering investors can score 4.5% to 5% yields on government money market funds.

For others looking for a bit more, cash-like ETFs could be the answer. These actively managed funds are essentially prime money market funds with floating NAVs to begin with. ETFs like the iShares Ultra Short-Term Bond ETF or the SPDR Ultra Short-Term Bond ETF feature strong liquidity and offer a chance to boost cash yields. Pairing one of these funds with a traditional government-only money market fund could be the way to have liquidity, yield, and stability in one package.

Money Market ETFs

These money market ETFs were selected based on YTD total return, which range from 3.4% to 4.95%. They have expenses between 0.08% to 0.36% and have assets under management between $580M to $23B. Their yields are between 3.8% and 4.7%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| MINT | PIMCO Enhanced Short Maturity Active Exch Tr | $9.73B | 4.95% | 4.15% | 0.36% | ETF | Yes |

| PULS | PGIM Ultra Short Bond ETF | $5.5B | 4.6% | 4.71% | 0.15% | ETF | Yes |

| ICSH | BlackRock Ultra Short-Term Bond ETF | $6.184B | 4.02% | 4.05% | 0.08% | ETF | Yes |

| ULST | SPDR SSgA Ultra Short Term Bond ETF | $583.7M | 3.8% | 3.8% | 0.2% | ETF | Yes |

| JPST | JPMorgan Ultra-Short Income ETF | $22.78B | 3.4% | 3.97% | 0.18% | ETF | Yes |

The Bottom Line

Money market funds are supposed to be safe, but that hasn’t always been the case. The SEC’s new rules deliver on that promise, boosting liquidity and stability of these assets. While yields may be compressed because of that legislation, investors have options to boost their income. Ultimately, the funds are now again a prime place for investors to park their allocated cash.

1 Western Asset (July 2023).