If there’s been one security that has captured investors’ fascination over the last year, it has to be the lowly T-Bills. Plenty of money has flowed into the fixed income asset, and it’s easy to see why. These very short-term government bonds have been quick to recognize the Federal Reserve’s path to higher interest rates. As such, T-Bills are paying rates not seen in over a decade.

But investors may want to rethink just how much money they are allocating to these short-term bonds.

The rates paid by T-Bills are predicted to decline. The Fed’s recent pause could indicate that this decline is coming sooner than we think. For investors, holding too much cash in T-Bills might not be the best scenario.

Quick to Realize Higher Interest Rates

Treasury Bills, or T-Bills, are short-term bonds issued by the Federal government with a maturity of one year or less. The Treasury issues them in 4-, 8-, 13-, 17-, 26- and 52-week increments. However, investors purchasing them on the secondary market can find T-Bills maturing in just a few days. T-Bills are considered zero-coupon bonds, in that they don’t pay periodic interest. The bonds are issued at a discount to par value and when the bond matures, the Treasury pays investors the full amount, reflecting the interest earned.

This short-term nature is very positive when the Fed is on a path to tightening. Because T-Bills mature fast and can be rolled over into new bonds quickly, they almost instantly reflect changes to higher interest rates. Likewise, they generally don’t fall in price when the Fed tightens. Afterall, if you know that in a week or two, you’ll be able to buy a higher-yielding bond, there’s no reason to sell. This isn’t true for a 10-year or 30-year bond, in which you’ve locked in income for decades.

So, with inflation rising and the Fed raising rates at the fastest pace in 40 years, T-Bills have quickly become the fixed income superstar. T-Bill rates have skyrocketed since the beginning of 2022, and now yield levels not seen since before the Great Recession. For example, at the time of writing, a one-year T-Bill was paying 5.36%, a 6-month T-Bill was paying 5.52% and a 3-month T-Bill was paying 5.53%. To put that in context, these bonds were paying 3.09%, 3% and 2.56% a year ago. 1

With these short-term, government-backed bonds now yielding over 5%, investors have plowed some hefty assets into the security.

What Goes Up, Must Go Down

It’s easy to see why T-Bills have become the fixed income asset class du jour. Particularly, when adding in some of the tax advantages, as their interest is free from state and local taxes, and uncertainty with the economy.

The issue is the Fed is likely to slow down its pace of rate increases. Already there are indications that the Fed may be winning the war on inflation. The CPI has slipped from levels not seen since the 1980s to around 3.5% today. Various economic indicators have also begun to dip. As such, the Fed has started to take its foot off the gas. The last few rate hikes have only been at 0.25% increases. Moreover, the Fed has now paused twice: once in June and again at its last meeting this September.

The issue now is whether or not the Fed will continue to pause or even cut rates if the economy dips too much, which could spell a major problem for T-Bills.

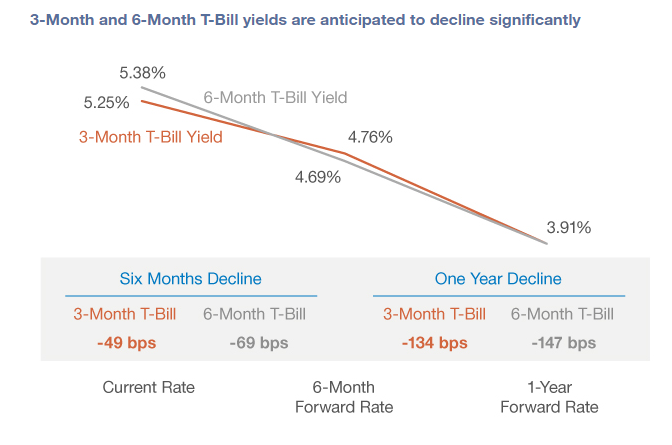

Because of their short-term nature, they reflect changes in rates quickly. It’s the reason why they are currently yielding so much. Now, while they tend to be stable in terms of price, newly issued bills will reflect lower yields just as fast as the Fed pauses and cuts. This chart from insurer and investment manager New York Life shows the predicted decline in the 3- and 6-month T-Bill rates over the next 6- and 12-month periods.

Source: New York Life

For investors in T-Bills, this is a major decline in income, and the interest they will receive by holding these short-term bonds. Ultimately, the good times in these short-term and safe bonds may be coming to an end.

Locking In Income

The flip side to this is that longer-term bonds “keep” their coupons for the long term. So, while T-Bills mature and quickly reflect changes to interest rates, a 10-year bond already on the market will still have the higher coupon for quite some time. For investors, this is a critical time to lock in higher yields and prepare for the Fed cutting rates.

That might mean selling T-Bills or ETFs like SPDR Bloomberg 1-3 Month T-Bill ETF, as well as not buying new ones when these bonds mature.

So, what to do?

For those still looking for safety and liquidity, going slightly out on the duration ladder may be of benefit. Short-term bonds have maturities of 2 to 5 years and offer many of the same benefits as T-Bills, but will yield more when the Fed cuts. A fund like the Vanguard Short-Term Bond Index Fund or iShares 1-3 Year Treasury Bond ETF could be suitable as a T-Bill replacement.

For investors looking for more of a return aspect and not so much a safety position, going long is the answer. The idea is to lock in that higher yield. Simply buying the Bloomberg US Aggregate Bond Index via iShares Core U.S. Aggregate Bond ETF could be all you need to lock in yield.

Other options? Corporate and municipal bonds.

According to New York Life, munis make for an ideal selection. With their tax advantages, munis are yielding close to 6% on a tax-equivalent yield. That’s a wonderful chance for investors to truly lock-in similar yields to T-Bills for the long haul. Likewise, corporate bonds from top companies are paying close to a 4 to 5%. Here again, investors have a prime opportunity to own some quality with a high long-term yields.

Finally, going active in a so-called go-anywhere or opportunistic bond fund might make sense. Here, managers can buy whatever they see fit. While many have loaded up on short-term T-Bills, top managers have been moving outwards to other opportunities and do the “lock-in” for you.

Fixed Income ETFs & Mutual Funds

These funds are selected based on their suitability as T-Bill replacements. They are sorted in descending order by YTD total return. They have expense ratios between 0.03% to 0.68% and have AUM of $700M to $94B. Their dividend yields range between 2.5% and 5%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FADMX | Fidelity® Strategic Income Fund | $13.1B | 3.8% | 4.3% | 0.68% | MF | Yes |

| SPBO | SPDR Portfolio Corporate Bond ETF | $704.5M | 1.9% | 5% | 0.03% | ETF | No |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 1.8% | 3.3% | 0.35% | ETF | Yes |

| BOND | PIMCO Active Bond Exchange-Traded Fund | $3.676B | 1.7% | 4.4% | 0.56% | ETF | Yes |

| BSV | Vanguard Short-Term Bond Index Fund ETF | $60.2B | 1.4% | 2.7% | 0.04% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26.021B | 1.4% | 3.1% | 0.15% | ETF | No |

| ITM | VanEck Intermediate Muni ETF | $1.76B | 0.5% | 2.5% | 0.24% | ETF | No |

| AGG | iShares Core US Aggregate Bond ETF | $93.275B | 0.3% | 3.3% | 0.03% | ETF | No |

In the end, T-Bills react quickly to changes in rates, which has been great as the Fed has raised interest rates. However, as they cut and pause rates, T-Bill investors will feel the pain. The time to lock in higher income is now.

The Bottom Line

T-Bills have quickly become the investor asset of the moment. However, much of that has been driven by the current path of rate hikes. Going forward, T-Bills are predicted to see their coupons decline as the Fed cuts rates. That means it’s time for investors to think about longer options for their income.

1 YCharts (Sep 2023). 6 Month Treasury Rate (I:6MTCMR)