Fixed income is supposed to be the “safe” asset class. After all, the return of principal and steady coupon payments are designed to be less volatile than other asset classes. But after last year, investors were reminded that bonds aren’t 100% risk-free. With the Fed raising rates, the broader bond market sank hard.

The questions to consider are: a) is there a way to have your cake and eat it too? and b) can we find safety and yield in the current market?

The answers to both may be a resounding yes. Short duration bonds are currently paying some of the best yields in years and offer less risk than longer dated bonds. And with the Fed still increasing benchmark rates further, the opportunity in short duration bonds is only getting stronger.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

Longer Duration Kill

When investors think about risks associated with bonds, the number one thing that comes to mind is credit quality: How reliable is the entity I’m lending to in terms of paying me back? There are numerous credit ratings agencies that look at various scenarios and assign a score to each bond/entity. In the case of Uncle Sam that measure is a 99.9999% certainty that you’ll get your money back.

However, there is another risk that investors need to consider. And that’s duration or interest rate sensitivity risk. Bonds and interest rates are like oil and vinegar – they don’t mix very well. When interest rates rise, such as today, bond prices will fall. The reason is that when a new similarly maturing and credit-rated bond comes to market, it will have a higher interest/coupon to reflect the interest rate change. As a result, bonds currently on the marketplace will drop in price to match that new yield. Duration is the measure of how much a bond will tank when rates do rise. Longer dated bonds have higher durations and will drop by more than those on the shorter end of the spectrum.

Which brings us to the opportunity.

Short duration and ultra-short duration bonds are those that mature within 1 to 3.5 years and 61 days to a year, respectively. These bonds feature a wide variety of credit quality and issuers. Because these bonds mature fast, credit risk and interest rate risk is usually low. Because of their short timelines, new short duration bonds are able to “roll over” faster to reflect changes in interest rates, so they don’t drop as much as bonds with 30 years left to go. Secondly, the odds of default are lower if the issuer has just a month or so to pay back the bond. The market is very good at predicting these sorts of events.

The combination makes short duration bonds a sweet spot for both interest rate and credit risk protection.

Why Go “Short” Today?

Given their attributes and benefits, short duration bonds have long been a conservative fixed income investor’s best friend. And that relationship is getting strong in the current market environment. For one thing, the Fed isn’t done raising rates.

Despite slowing their pace of the rate hikes, the Fed is still on pace to boost short-term rates to over 5% this year. That will continue to hit bonds with longer durations and produce mixed returns. However, shorter bonds will continue to be protected.

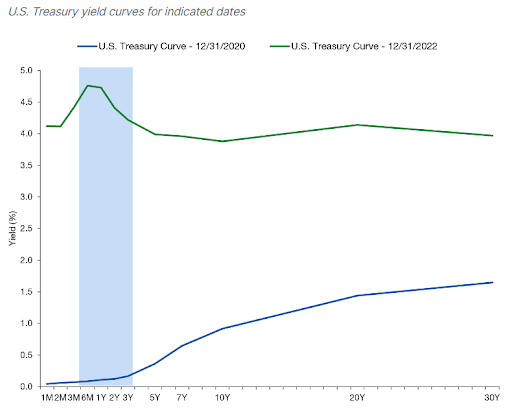

At the same time, short duration bonds are paying some hefty yields. In fact, what we have today is an inverted yield curve, with short-term rates paying more than longer termed ones. This chart from investment manager Lord Abbett highlights the inversion. You can currently pick up a higher yield with less rate risk than tying your money up for 20 or 30 years.

Source: Lord Abbett

What’s most staggering about those yields is that short duration bonds are paying much higher rates than the average savings account or CD. Thanks to stimulus efforts during the pandemic and reserve gathering, the average U.S. bank has nearly too much capital on its balance sheet. With those larger reserves, banks don’t have to attract deposits with high rates on savings accounts. For example, at the time of writing, Bank of America was offering a paltry 0.01% on its basic savings product. A 6-month T-Bill issued from Uncle Sam is currently paying 4.67%.

Making the Move to Short Duration Bonds

For investors looking to score good yields with a dose of safety and reduced interest rate risk, short and ultra-short duration bonds make a ton of sense for their portfolios. It’s particularly advantageous for those investors with larger cash balances or those with conservative tilts such as retirees or those near-retirement. Buying them is pretty easy too. Simply logging onto a brokerage account or TreasuryDirect and clicking “buy” could be all an investor needs to do.

However, taking a broad approach may be better for investors. And thanks to the proliferation of ETFs, there are numerous choices available and some funds are quite large. ETFs like the BlackRock Short Maturity Bond ETF (NEAR), SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and the $25 billion JPMorgan Ultra-Short Income ETF (JPST) all provide exposure to a mixture of short duration bonds and each yields in excess of 4%. However, these funds aren’t the only choices.

By adding short duration bonds to a portfolio, investors can ultimately get better yields, lower interest rate sensitivity and still have plenty of safety of principal. It’s a rare win-win.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.