Growth stocks have once again entered the chat. Thanks to the Fed’s potential to pause on rates, surging technology earnings and the fact that inflation has been slowing, investors have poured plenty of dollars into growth stocks recently. This has helped send the major growth stock indices to new highs.

However, investors may be exposing themselves to plenty of newfound risks.

In that, junk bonds may be a better alternative, according to BNY Mellon subsidy and fixed income specialist Insight Investment. Thanks to their high yields, junk bonds could perform like growth stocks over the next few quarters with much less risk.

For investors, replacing growth with junk may be in order.

Growth Is Riding High

To see how fast investors have returned to growth stocks, simply pull a chart of Nvidia. The chip maker has exploded – up over 200% year-to-date. And NVDA isn’t alone. Microsoft, Apple and Facebook have all been on a tear in recent weeks. All in all, the Russell 1000 Growth Index, which includes large- and mid-cap stocks, is up a staggering 26.6% so far this year. The broader Russell 1000 has only returned about 15% year-to-date.

The surge in growth can be traced to the potential of a Fed pause amid declining inflationary pressures.

The problem is, investors starting to bet big on growth may be setting themselves up for a bit of a failure and potential losses. For starters, the Fed hasn’t actually indicated that it’s done with its rate hikes. In fact, it’s signaled just the opposite. Recently, at its Jackson Hole symposium, Fed Chair Jerome Powell indicated that the Fed still has more work to do and that more rate hikes are on the table.

Secondly, the surge in growth stocks comes on the back of a deteriorating economy and possible recession risk. While earnings have been decent, growth stocks are now trading at rich valuations considering the current and potential environment. Right now, the NASDAQ can be had for a forward P/E of around 35, while its CAPE sits closer to 45. Both are above historic norms, close to record highs (CAPE) and could be considered overvalued.

This has set up investors for potential risks and losses within their portfolios. Investors are playing like the Fed is now down with its tightening, when, in fact, it’s not and the economy is starting to look shaky.

Junk Bonds May Be the Answer

However, there may be another way to get growth-like equity exposure without the current risks for the sector – and that’s within high-yield or junk bonds. According to Insight Investment, investors may want to make the swap.

With the Fed keeping rates at elevated levels, high-yield bonds are now paying 8% to 9%. That’s a wonderful yield and offers growth stock-like returns. With the Fed still raising rates and a possible recession on the horizon, growth stock returns have been pushed down to the 6% to 8% range. Right now, investors can buy junk bonds and make the same return via its coupons.

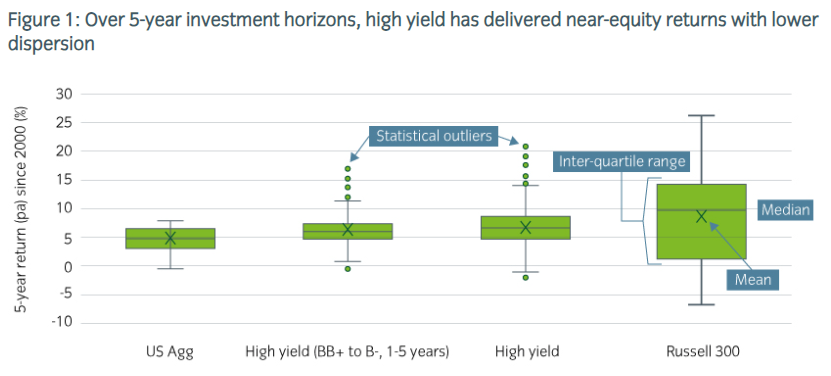

The kicker according to the fixed income specialist is that high-yield bonds have been able to deliver strong returns with far less volatility and dispersion than equities. Since the year 2000, equities and junk bonds have had similar return profiles on rolling five-year periods. However, junk bonds have been the less volatile choice, with a 9% annualized standard deviation versus 16% for stocks. 1

This chart from the investment manager highlights the lower volatility of returns.

Source: Insight Investment

That lower volatility comes into play during periods of market drawdowns. During market sell-offs and recessions, junk bonds tend to not fall by as much as growth equities, partly because bonds are senior to equity in the capital structure. The so-called “pull-to-par” nature keeps them afloat.

At the same time, junk bonds are not as risky on a default basis as you would believe. Ratings agencies typically predict that 3% to 5% of junk bonds will default in a single year. However, the actual number is closer to 2.3%. At the same time, looking at total losses – meaning investors get nothing in the case of bankruptcy – is also rare. High-yield recovery rates have traditionally averaged 45%.

On the other hand, equity investors get zero in the case of bankruptcy, and those bankruptcies tend to happen more frequently in start-ups and growth equities. 2

Junk Bonds Over Growth

With return expectations low, valuations high and risks growing for growth equities, junk bonds are starting to look very good indeed. Remember, the kind of returns we’ve been seeing in growth isn’t historically normal. Growth tends to go gangbusters and decline rapidly. To that end, buying junk bonds and coupon clipping to get the same average rate of return with less risk/volatility may be the best option. Taking money off the table and replacing it with high-yield bonds is a smart move.

Investment Insight suggests using ETFs to get that exposure. The investment manager cites the liquidity advantage of ETFs over trying to buy junk bonds individually. Junk bonds trade in the over-the-counter exchanges and pricing them can become difficult for retail investors. Not so for a fund like the SPDR Bloomberg High Yield Bond ETF or iShares Broad USD High Yield Corporate Bond ETF, which trade thousands of shares each day. By using one of the over 100 ETFs in the junk bonds space– both active and passive – investors can gain a liquidity advantage.

Junk Bond ETFs

| Ticker | Name | AUM | YTD Total Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| SRLN | SPDR Blackstone Senior Loan ETF | $4.6B | 8.49% | 0.70% | ETF | Yes |

| HYLS | First Trust Tactical High Yield ETF | $1.54B | 5.70% | 1.27% | ETF | Yes |

| SPHY | SPDR Portfolio High Yield Bond ETF | $1.36B | 5.48% | 0.05% | ETF | No |

| USHY | Lyxor ESG USD High Yield (DR) UCITS ETF | $9.4B | 5.42% | 0.22% | ETF | No |

| JNK | SPDR Bloomberg High Yield Bond ETF | $8.51B | 5.16% | 0.40% | ETF | No |

| HYLB | Xtrackers USD High Yld Corporate Bd ETF | $3.93B | 4.88% | 0.20% | ETF | No |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | $15.2B | 4.47% | 0.49% | ETF | No |

| PHB | Invesco Fundamental High Yield Corp Bd ETF | $0.55B | 3.64% | 0.50% | ETF | Yes |

While investors may be hesitant to sell all their growth stocks, taking some money off the table – particularly after this year’s huge run-up in growth – and placing it into high-yield bonds is a smart move. Ultimately, investors will get the same sort of long-term return profile without many of the risks associated with growth equities.

The Bottom Line

Growth stocks have been on a huge run-up this year, perhaps too much. With that, alternatives may be in order. Junk bonds could be an option. With their high yields, lower risk profiles and growth equity-matching returns, buying junk could be a smart move. And ETFs make that choice easy.

1 Insight Investment (June 2023). Credit Insights: Replacing equities with high yield

2 Insight Investment (January 2023). MAKING SENSE OF HIGH YIELD DEFAULT RATES