Sometimes bad things happen to good companies. Bad product designs, lawsuits, strategic missteps, new competitors, etc. can all hinder a firm’s near-term success. Often, we see these issues show up on the equity side of the equation, with sliding stock prices, higher yields, and lower valuations. But equity investors aren’t the only ones who feel the pain. Bond holders often feel the pinch too.

And just like sliding equity valuations can signal potential values, so too can bond prices and credit ratings.

Dubbed Fallen Angel bonds, these former high flyers, which have migrated into junk status, may offer some of the best yields and returns around. The best part is that investors now have a multitude of ways to access these bonds for their fixed income portfolios.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

Downgraded Credit Ratings

Just like you and I, corporations have credit scores. And just like us, these credit scores determine what corporations pay for the debt and capital they need. While there are a variety of credit ratings, there are two broad categories into which they fall: investment grade and junk.

The major credit rating agencies—S&P Global, Fitch, Moody’s—periodically check in on a company and re-evaluate their ratings, especially after a negative or positive event occurs. Sometimes, they happen to re-evaluate firms lower thanks to a variety of issues. Everything from deteriorating business trends and lower cash flows to rising debt amounts and a weakening of balance sheets can change their credit rating and result in a downgrade. When this downgrade happens, a firm’s already issued bonds will generally fall in price as investors demand a higher yield for the new risks associated with holding that bond.

If a firm has an investment grade rating and drops to a slightly lower investment grade rating, not much may happen. But firms sitting on the lowest tier of investment grade that are downgraded into the first category of junk get a special name: Fallen Angel bonds. The line between investment grade and junk/high-yield status is ‘BBB’ rating, as assigned by Standard & Poor’s.

Why Focus on Fallen Angel Bonds?

It turns out these ‘just into junk status’ bonds may be the sweet spot for investors looking for income and capital gains potential. For one thing, their ability to repay their debts hasn’t really changed.

Thinking about it in terms of consumers’ credit scores, going down from a FICO score of 660 to 650 does not necessarily change the equation on how well a person can pay for a mortgage or auto loan in real terms. The same could be said for companies. A slight dip in credit rating does not change cash flows or cash on hand figures. Credit ratings are just based on perceived outcomes. In fact, default rates for Fallen Angel bonds tend to track investment grade bonds rather than other high-yield ratings.

For investors, Fallen Angels can be an opportunity to pick up some extra yield because bond prices have fallen due to the re-evaluation without adding that much more risk to their fixed income portfolios.

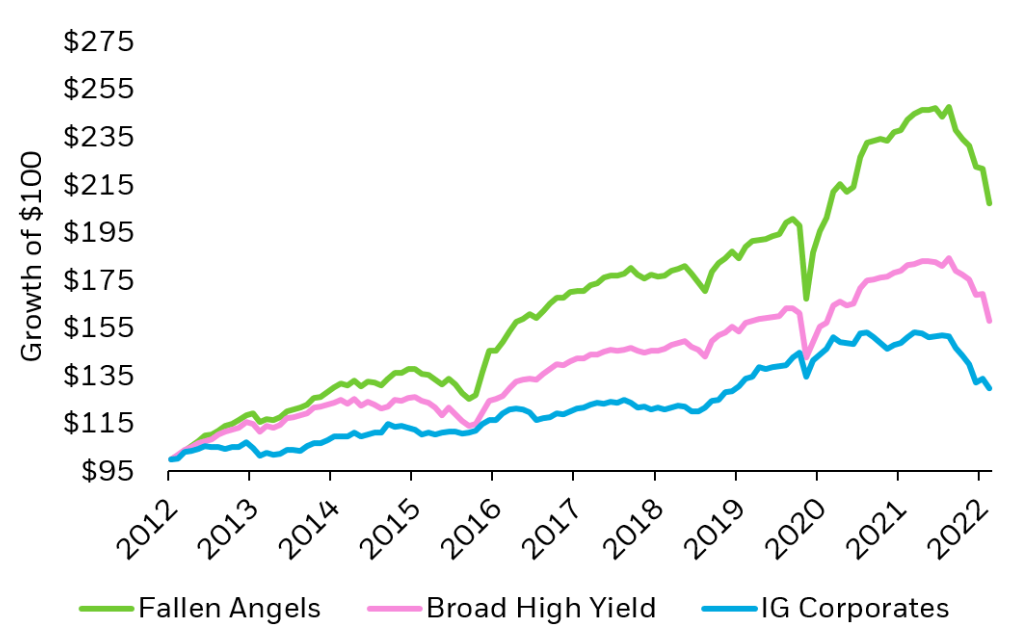

A Fallen Angel’s status as the sweet spot is assured when looking at their returns as well. Over the last decade, Fallen Angel bonds have managed to crush both the entire high-yield/junk market as well as investment grade corporates. This chart from BlackRock & Bloomberg illustrates the return potential.

Source: BlackRock

But there is another reason to consider Fallen Angel bonds in a portfolio: a reduction of interest rate risk.

Because they have already ‘fallen,’ Fallen Angel bonds tend to do well and rise in price rather than decline like other bond types. According to Van Eck, the ICE US Fallen Angel High Yield Index over the last 20 years has produced positive returns in each of the Fed’s tightening cycles. Generally, rising rates reflect expectations for rising growth ando, as such, are positive for junk bonds overall. Investors flock to Fallen Angel bonds based on their perceived ability to become investment grade once again as growth happens.

You can see this illustrated today, with Fallen Angel bond indexes staying steady as the Fed has raised rates, while outperforming both the whole high-yield sector and investment grade bonds.

Finding Fallen Angel Bonds for Your Portfolio

Given the benefits of Fallen Angel bonds for fixed income investors, adding them to a portfolio makes sense. Investors can certainly add individual bonds to a portfolio. Running a screener on a brokerage’s website and looking for BBB rated bonds would be an easy solution. However, buying individual bonds loses diversification benefits and often comes with higher initial investment minimums.

A better bet could be focusing on the ETFs that track the various Fallen Angel bond indexes or target BBB bonds. Both the Van Eck ICE US Fallen Angel High Yield ETF (ANG) and iShares Fallen Angels ETF (FALN) target the opportunity. Each features a wide range of bonds in the ‘just into junk’ category providing plenty of diversification benefits. As for yields, FALN is currently paying 8.13%, while ANGL is paying 7.97%.

Another option could be iShares BBB Rated Corporate Bond ETF (LQDB). LQDB specifically targets bonds rated BBB. Now, not all bonds in this category are Fallen Angels. Some start out with these ratings. However, it provides exposure to them on a whole and could be a good bet for investors.

The Bottom Line

In the end, Fallen Angel bonds could provide salvation. The category offers plenty of rising rate protection, high yields, and the chance for higher returns than traditional high-yield sectors and even investment grade bonds. Thanks to ETFs, adding the asset class is easy in a portfolio.

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.