Environmental, social, and governance (ESG) investing may have lost some of its luster. Thanks to political influence and other factors, ESG and socially responsible investing has quickly gone from the market’s darling to its pariah. At least that is true on the surface and in the headlines.

Looking at actual issuance is another story. Sustainable bond issuance has continued to grow rapidly.

And according to S&P Global, the sustainable bond market is going to be big and on par with many other bond sectors. For fixed income investors, the growth of sustainable bonds, their use, and potential portfolio benefits is certainly exciting.

Sustainable Bonds in a Nutshell

For many investors, ESG has been equated with equities, with nearly one in three dollars’ worth of assets being managed under the ESG banner. In the early days of the style, ESG simply meant removing certain stocks—like tobacco, fossil fuels, and weapons’ producers—from the larger indices. Building on this head start, index providers and other managers developed rules to garner ESG metrics. From there, institutional investors used these new standards.

But the bond side of the equation has quickly become very large in recent years as issuers look to finance various social and green programs. This brings us to the market for sustainable bonds.

Green, social, sustainability, and sustainability-linked bonds (GSSSBs) are IOUs issued by companies, governments, and municipalities used to finance or refinance a combination of green and social projects or activities. This can include renewable energy, clean transportation, wastewater management, green buildings and affordable housing, access to essential services, and affordable basic infrastructure. They can cover one of these ideas such as Green Bonds for renewable energy projects or Social Bonds for a new hospital in a low-income area. However, they may also cover both ideas with Sustainability Bonds.

Surging Growth for GSSSBs

Despite the headlines calling for the death of ESG, and several high-profile states such as Florida and Texas excluding them from their pension/endowment portfolios, the market for GSSSBs has continued to grow. The combination of investor demand for ESG in their bond portfolios and issuers looking to launch needed sustainable projects has created an upswing in overall issuance.

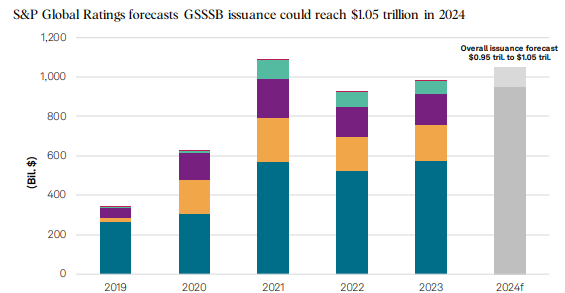

According to S&P Global, the market for sustainable bonds will hit $1.05 trillion this year. That’s up from $0.95 trillion recorded in 2023 and $0.93 trillion issued in 2022. All in all, that’s about 14% of all predicted bond issuance for 2024. This chart from the research company shows the uptrend in new sustainable bond launches. For 2021, pandemic-era stimulus caused a temporary spike in green bond launches and skewed the data. 1

Source: S&P Global

Looking at totals, the global GSSSB bond market is expected to have $6.6 trillion in total issuance by the end of the year. This makes it larger than both the U.S. high-yield bond ($1.94 trillion) and municipal bond ($3.8 trillion) markets combined.

The key for that growth has been the surge in issuance by sovereign nations. For example, Japan recently issued its first $11 billion worth of sustainable bonds, while Germany, France, and the U.K. have continued to tap the ESG bond market for their needs. S&P Global also predicts that emerging market nations have been quick to add sustainable bonds to their borrowing activities. For example, Brazil recently issued more than $2 billion in ESG bonds.

With emerging markets now entering the fray—with domestic and international investors—the sustainable bond market could seriously hit critical mass.

Betting on the Greenium

So why have investors been so keen to gobble up green bonds and ESG-related debt? The answer may be simple: a better return.

It turns out that sustainable bonds perform better than traditional bonds and come with a so-called ‘Greenium’ to their price.

Applying ESG metrics to a firm’s credit rating, investors can potentially unearth problems that were hidden before. For example, how does climate change impact a firm’s future ability to generate cash flows or how will increased wildfire activity impact an insurance company’s underwriting profits down the road.

This translates into extra returns. According to a recent Morgan Stanley report, sustainable fixed-income funds saw an average return of 10% in 2023. This compares to an average return of 6.4% for traditional fixed-income funds. Looking longer term, there is about a 2% positive return per year difference for ESG bonds versus traditional bonds. 2

So, we have expanding issuance and better returns. That’s a real recipe for success for investors. And luckily, getting access to sustainable bonds is pretty easy. Thanks to the ETF revolution, there are now countless choices to build a sustainable bond portfolio, both active and passive.

ESG Bond ETFs

These funds were selected based on their exposure to various social, green, and sustainable bonds issued by sovereigns, municipalities, and other enterprises. They are sorted by YTD total return, which ranges from -3.1% to -0.26%. They have assets under management between $22M and $3.6B and expenses between 0.11% to 0.50%. They are currently yielding between 3.3% and 6.1%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| NUHY | Nuveen ESG High Yield Corporate Bond ETF | $105M | -0.26% | 6.1% | 0.31% | ETF | No |

| NUSA | Nuveen ESG 1-5 Year U.S. Aggregate Bond ETF | $22.9M | -0.7% | 3.7% | 0.16% | ETF | No |

| ESGB | IQ MacKay ESG Core Plus Bond ETF | $217M | -1.1% | 5.1% | 0.50% | ETF | Yes |

| GRNB | VanEck Green Bond ETF | $89.5M | -1.6% | 3.4% | 0.20% | ETF | No |

| VCEB | Vanguard ESG U.S. Corporate Bond ETF | $516M | -2.1% | 4.2% | 0.12% | ETF | No |

| NUBD | Nuveen ESG U.S. Aggregate Bond ETF | $327M | -2.4% | 3.3% | 0.16% | ETF | No |

| EAGG | iShares ESG Aware U.S. Aggregate Bond ETF | $3.56B | -3.1% | 3.8% | 0.11% | ETF | No |

| SUSC | iShares ESG Aware USD Corporate Bond ETF | $1.08B | -3.1% | 4.3% | 0.18% | ETF | No |

All in all, sustainable bond issuance continues to grow as the world looks to fill various social and green initiatives. This is despite the recent ESG backlash from several states and pundits. On the whole, this is a positive sign for investors. ESG and various GSSSBs can boost returns and provide an extra margin of safety when it comes to risk analysis. With the number of launches and this potential in tow, investors may want to consider sustainable bonds for their portfolios.

The Bottom Line

Sustainable bond issuance is set to hit over $1 trillion this year according to S&P Global. That’s wonderful news for investors. Extra returns and lower risk await those looking to take ESG into their bond portfolios. ETFs make that decision easier.

1 S&P Global (February 2024). Sustainable Bond Issuance To Approach $1 Trillion In 2024

2 Morgan Stanley (February 2024). Sustainable Funds Outperfromed Peers In 2023