When it comes to emerging markets, many investors think of them as growth elements for their portfolios. That is, they represent the equity side of the equation. And as such, their allocations to emerging markets stop there. But, that’s really a shame – emerging markets are a fruitful place for investors in fixed income.

Right now, there are plenty of catalysts when it comes to emerging market bonds.

Lower inflation, commodity-backed debt as well as lower defaults amid high yields offer investors a chance to add plenty of income muscle to their bond portfolios. The best part is that emerging market debt can act like equities – but with much less risk. For investors, the chance to buy could be now.

A Troubled 2022

It’s not surprising that emerging market debt followed much of the broader bond sector lower last year. As the Fed raised rates, the sector fell hard, perhaps more than most. All in all, the J.P. Morgan EMBI Global Core Index, which is the sector’s de facto proxy, lost 18.6% in 2022 including the interest payments. That’s about 5% more than the investment-grade U.S. bonds and was one of the worst-performing fixed income sector in total.

For one thing, investors fled risk assets. Let’s face facts: They don’t call them “emerging” for no reason. With T-bills and cash currently paying 5% – what EM bonds were paying at the start of last year – there was no point to take on extra risk by owning them.

Secondly, the Fed’s rate hikes hit emerging market debt in another way, raising potential default risks. The vast bulk of emerging market debt – albeit, this has significantly changed in the last decade or so – is issued in the U.S. The original idea was that this was done for safety and to provide access for emerging market nations to investors in the West.

However, as rates rise, currencies tend to get stronger. In that aspect, it now takes more dollars for emerging markets to pay back their loans, because of currency translations. Default risk increases and strains on emerging market nations and companies grow. So, it was not surprising to see both Zambia and Sri Lanka default on more than $50 billion worth of bonds in 2022.

It’s easy to see why emerging market debt was hit hard last year.

A Promising Outlook

But times could be changing for emerging market bonds, and the outlook for the sector is a bit sunnier. All while EM debt pays some very juicy yields.

For starters, many emerging market nations took last year’s surge of inflation in stride. Already at higher inflationary metrics, many emerging market central banks started to raise rates long before the U.S. did, pushing short-term yields much higher than U.S. counterparts and attracting capital once again. At the same time, many emerging markets derive a lot of their tax and revenues from commodities. So, the boost in raw materials, such as iron ore, gold and oil, has helped pay their coffers.

Then we have the Fed itself to consider. Powell & Co. have started to dial back the severity of rate hikes, boosting benchmark rates by only 0.25% at a time and even pausing back in June. With U.S. inflationary trends moving lower and the economy starting to slow down, the Fed may be inclined to stop raising for a bit. That is bullish for emerging market bonds.

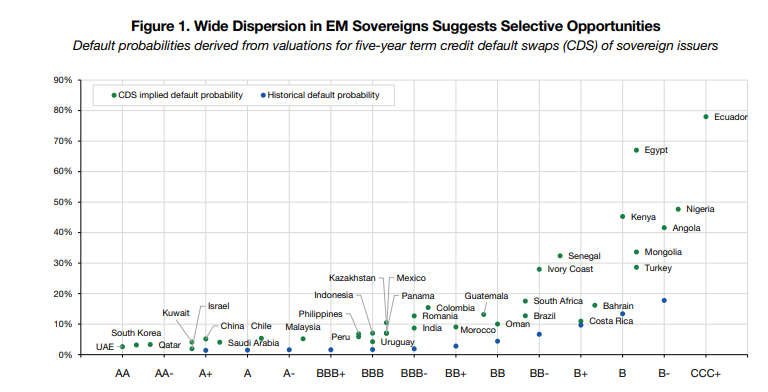

Finally, finances for many emerging market nations may be looking up as well. The lingering effects of the pandemic may finally be done, with China once again reopening. Meanwhile, export demand and continued economic improvement in a variety of regions have helped reduce default risk. Several nations, such Nigeria and Angola, have been able to restructure debt to help improve their standings. All in all, this has helped on the credit default swap front and implied risk.

Source: Lord Abbett

This chart from asset manager Lord Abbett shows the vast bulk of investment-grade emerging market debtors has low default risk. You really have to get into the speculative side of things before default risk spikes.

Time to Add EM Bonds?

Improving dynamics makes for an interesting case for emerging market bonds. Another interesting point? Their yields. Right now, investors can snag the J.P. Morgan EMBI Global Core Index at a hefty 7% yield.

Like junk bonds, EM debt can act more like equities with less risk. The vast bulk of EM issues trade for under par, given the default risk. Albeit, the current environment suggests that default rates will be low and that much of the bad news has been overexaggerated. This leads to an interesting total return element for a fixed income portfolio.

How to get that exposure?

The easy answer is the iShares J.P. Morgan USD Emerging Markets Bond ETF, which tracks the previously mentioned index. At nearly $16 billion in assets, the ETF is the largest in the category and a great starting point for investors. The Vanguard Emerging Markets Government Bond Index Fund is another high-quality choice.

Emerging Market Passive Bond ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| EMD | Western Asset Emerging Mrkts Dbt Fnd Inc | $15.7B | -2.2% | 0.39% | ETF | No |

| VWOB | Vanguard Emerging Markets Govt Bd Idx ETF | $3.44B | 0.9% | 0.22% | ETF | No |

| EMLC | VanEck JP Morgan EM Local Currency Bond ETF | $3.49B | 4.9% | 0.32% | ETF | No |

| PCY | Invesco Emerging Markets Sovereign Debt ETF | $1.59B | 3.7% | 0.50% | ETF | No |

Going active may also be a smart move when it comes to emerging market bonds. As one of the largest bond universes out there, with different characteristics of region and nation, an active manager can comb through and find bargains. Moreover, a lot of EM managers will also hold EM corporate and other high-yield debt to help boost returns and yield.

Emerging Market Active Mutual Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| DBLEX | DoubleLine Emerging Markets Fixed Income Fund Class I | $507.6M | 0.7% | 0.9% | MF | Yes |

| EADOX | Eaton Vance Emerging Markets Debt Opportunities Fund Class A | $67.5M | 2.2% | 1.1% | MF | Yes |

| FEMDX | Franklin Emerging Market Debt Opportunities Fund | $39.5M | 7.2% | 1% | MF | Yes |

| LDMAX | Lord Abbett Emerging Markets Bond Fund Class A | $8.2M | 0.3% | 0.94% | MF | Yes |

At the same time, investors have plenty of local currency options for their portfolios. All in all, the asset class can function as a yield booster for a portfolio. Either going active or passive allows for investors to take advantage of the trends propelling emerging market bonds.

The Bottom Line

Like much of the fixed income segment, emerging market bonds were hit hard last year. However, improving trends and the number of tailwinds have continued to propel the bonds forward and still make good bargains for a portfolio. Adding either an active or passive approach could lead to a strong return, with high income potential.