While we think of bonds as stable in price, the truth is they move. And in some sectors of the bond market—like leverage loans, high-yield debt, and CLOs—they move a lot. Just like stocks, sometimes the price of a bond doesn’t currently reflect the true value or potential of the issue to be repaid or made whole. It’s here that investors can not only gain high income, but capital appreciation too.

Welcome to the world of opportunistic credit.

Once an asset class and strategy for high-net-worth individuals and institutions, new opportunistic credit and distressed debt funds allow anyone to participate. With returns strong for the sector, investors may want to do just that.

Opportunistic Credit Defined

Bonds and fixed income assets like leveraged loans have two basic components. One is the coupon rate, which is the interest paid on the bond. The other is the principal, which is repaid either over the life of the bond or when the security matures. However, when investors buy a bond on the secondary market, often the price they pay is different than the par value. Interest policy has a big influence on this as we’ve seen over the last year or so.

But the underlying fundamentals of the debtor also influence the price of the bond.

For firms that run into issues—such as declining cash flows, getting bad news or being subjected to lawsuits, employee/customer accidents, bankruptcies, etc.—can have their bond pricing being impacted in a negative way, often sending the price far below the par value.

However, not every firm that is subjected to terrible news or problems is going to disappear. And in that, its bonds could make for a great deal. This is essentially how opportunistic credit and distressed debt funds work. They do research and buy these bonds or loans with the idea of collecting big yields and then making some hefty capital gains on the bonds when they are repaid.

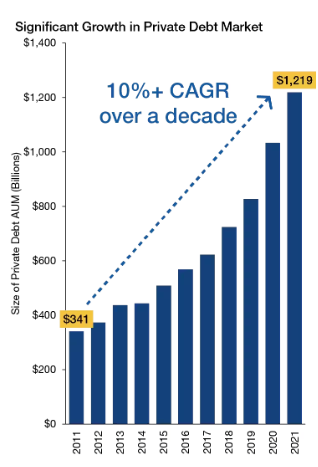

The opportunities for opportunistic credit funds have grown exponentially over the last decade. With many banks cutting down on their lending activity since the Great Recession, private debt issuance has surged. This chart from Lord Abbett shows the growth of private debt markets.

Source: Lord Abbett

The key is that the credit and bond markets allow illiquidity to provide plenty of openings for the mispricing of securities. The growth in private debt markets has increased the ability of distressed and opportunistic credit managers to use their craft.

The Win for Portfolios

For investors looking at opportunistic credit as a portfolio allocation, the benefits are vast.

The obvious answer is potentially higher income. Yields increase when bond prices fall. So, for bonds trading far below their par values, investors can score yields in excess of sector benchmarks. Sometimes those yields can stretch into the double digits. For example, B-rated CLOs yield nearly 19% on average. This can go a long way to boosting an investor’s current income.

Second, the ability to have capital gains as bonds are repaid or the broader investing community moving the price higher allows opportunistic credit funds to create equity-like returns, while still having lower volatility than stocks. Typically, opportunistic credit managers are buy & hold investors, holding bonds till they mature. This combination of price floors—with bonds already trading for pennies on the dollar—coupon payments, and principal repayment creates a steady return profile for the sector.

It’s hard to gauge opportunistic credit returns as a whole. The 100% active nature of the sector and focus on private debt makes indexing nearly impossible.

Adding a Dose of Opportunistic Credit to a Fixed Income Portfolio

Now could be a great time to consider adding opportunistic credit or a distressed debt fund to your fixed income portfolio. According to Lord Abbett, the current preference for liquidity of investors and institutions has left much of the private debt markets in a state of flux. Managers have a real chance to make a difference on bonds. Moreover, PIMCO suggests that the opportunities are growing. PIMCO believes that given higher rates, three-year default rates for loans across public and private markets will reach 10% to 15%. That should provide at least $300 billion in new distressed issues ripe for the picking. 1

With higher yields, less volatile returns, and plenty of new opportunities, investors may want to consider the space. The best part is that strategy has quickly been democratized. Once reserved for institutions, many mutual funds and ETFs now exist to take advantage of the strategy.

The newest one is the Simplify Opportunistic Income ETF. The active ETF run by Asterozoa Capital combs through high-yield, investment-grade, and distressed debt to find bargains among the wreckage. With an expense ratio of just 0.50%, it’s a very cheap way to add opportunistic credit to a portfolio. The SPDR Loomis Sayles Opportunistic Bond ETF is another top ETF choice.

For investors wanting to focus on established funds, many of the top bond managers have opportunistic credit funds among their offerings. Groups like PIMCO, Doubleline, Lord Abbett, and PGIM all offer top returning funds in the area. The key is to make sure expenses are low.

Opportunistic Credit ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| GUDIX | Guggenheim Diversified Income Fund Institutional | $6.9M | 6.1% | 0.48% | MF | Yes |

| RGCSX | Russell Investments Opportunistic Credit Fund Class S | $452.7M | 4.1% | 0.79% | MF | Yes |

| PCARX | PIMCO Credit Opportunities Bond Fund Institutional Class | $180.8M | 1.7% | 0.9% | MF | Yes |

| LARAX | Lord Abbett Credit Opportunities Fund | NA | 1% | 5.39% | MF | Yes |

| OBND | SPDR Loomis Sayles Opportunistic Bond ETF | $29.5M | 0.4% | 0.51% | ETF | Yes |

| DBL | Doubleline Opportunistic Credit Fund common stock | $236.4M | -4.2% | 1.72% | Other | Yes |

| CRDT | Simplify Opportunistic Income ETF | $37.5M | 0% | 0.95% | ETF | Yes |

The Bottom Line

A bond’s price can diverge from its value just like a stock. It’s here that investors can find values and larger yields. Opportunistic credit looks to find these values and exploit them, creating capital gains and higher income. For investors, equity-like returns and big yields can await those who take the plunge.

1 PIMCO (April 2023). Opportunistic Credit: Weakening Credit and Tightening Lending Conditions Drive Compelling Value