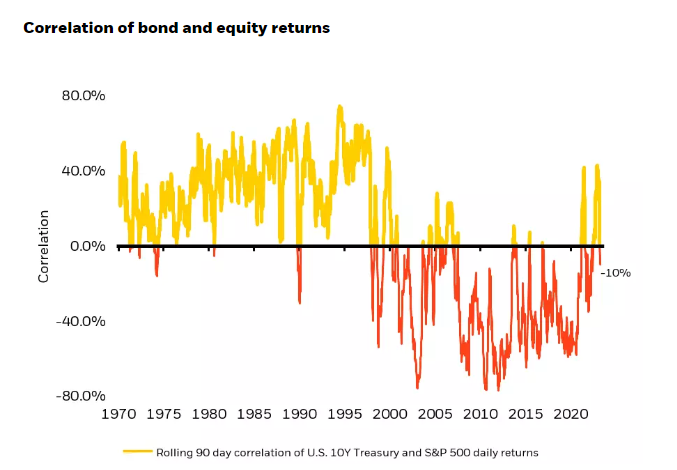

Fixed-income assets have long been used by investors as a hedge, providing downside protection against the equity side of their portfolios. Thanks to their steady coupon payments and returns of principal, bonds are able to balance out the volatility of stocks. However, that relationship isn’t always the case. High correlations between bonds and equities have muddied the waters.

But these days, the ability for bonds to hedge could be back with a vengeance.

According to BlackRock, correlations are starting to tip-toe back to being negative, which could make bonds the ballast portfolios need once again. For investors, it’s another compelling reason to consider higher bond allocations for their portfolios.

Diversification Equals Low Correlations

The main tenant of the modern portfolio theory (MPT) remains that diversification of asset classes can deliver steady long-term returns. As such, we tend to cobble together baskets of investments – stocks, bonds, gold, real estate, etc. – to meet this need and balance risk. The key piece to that comes down to correlations.

Correlation is basically the measure of the degree to which two securities move in relation to each other. Values for correlation fall within -1.0 and 1.0. Asset classes that move in the same direction will have positive correlations, while those that move in opposite directions will be negative.

For many portfolios and investors, bonds and stocks have formed the base for that diversification. The overall perception is that stocks and bonds always move in opposite directions. While that was true for much of the last two decades or so, the reality is that nowadays they don’t always follow that path. In fact, for much of the 1980s and 1990s, they moved in tandem. Last year showed investors that correlations for the asset classes can be very similar indeed, with both the S&P 500 and the Bloomberg US Aggregate Bond Index producing double-digit negative returns.

Getting Negatively Corelated Again

However, bonds may finally be moving back to being a good source of diversification. That’s the gist, anyway, according to a new whitepaper from Blackrock. After last year’s mega-decline, bonds may finally have gone back to hedge. The reason? Risk aversion and the Fed’s potential pause on rates.

Recessionary forces have started to make themselves known in a big way. The banking crisis and continued risk of deteriorating economic data have caused plenty of volatility in the equity sector. However, bonds have rallied on the risk concerns as they are considered a safe haven. According to Blackrock, this has “reset” correlations and made them negative again.

This chart from the asset manager shows the correlations between the S&P 500 and Aggregate Bond Index. After some recent tandem movements, the bond/equity correlation has now turned negative.

Source: Blackrock

All in all, rolling 90-day correlations between the 10-year and S&P 500 returns are now a negative 10%. This means when stocks dip, bonds should move higher, providing a hedge against declining equity prices. 1

The best part is that bonds may keep up their hedge properties for quite a while. That’s because the Fed may actually achieve the so-called soft landing that it has promised. Economic data remains steady, while inflation has started to cool off. This may support easing and better economic conditions.

Looking at the Goldman Sachs Financial Conditions Index (FCI), Blackrock summarizes that since the end of the Great Recession, changes to the FCI have explained about 30% of the stock/bond correlation and that positive changes to FCI have resulted in lower and negative correlations between the asset classes.

So, we have current weak conditions – with rate hikes and recession concerns supporting bonds – as a hedge today. Longer term, the potential for the Fed to bring inflation down and produce steadfast economic results will keep the negative correlations going for the longer haul.

A Great Time to Buy Bonds

For investors, the return of negative correlations between bonds and stocks is a huge win for portfolios. Once again, investors are able to buy bonds as a safe haven, allowing them to reduce their risk and actually find real diversification benefits for their investments.

While Blackrock’s white paper was short on details about how investors should proceed to getting that benefit, the firm’s focus in its study was the benchmark 10-year Treasury. Buying 10-year Treasury bonds either through a brokerage account or through Treasury Direct is pretty easy, and investors could certainly go that route.

However, ETFs could provide a better outcome and ease of use. The Blackrock-sponsored iShares 7-10 Year Treasury Bond ETF hones directly on a bond’s ability to be negatively correlated and could be used for investors looking for a hedge. The Vanguard Intermediate-Term Treasury ETF and the F/m Investments US Treasury 10 Year Note ETF also provide similar exposure.

And investors could always purchase any of the ETFs tied to the Bloomberg US Aggregate Bond Index. The Agg also provides the sweet spot for investors when it comes to negative correlations – owning intermediate investment-grade bonds including Treasuries, corporates, and MBS. While not perfect to the Blackrock paper, the Agg still provides negative correlations to stocks and offers ease of use when it comes to portfolio construction.

Intermediate Term Bond ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| BND | Vanguard Total Bond Market Index Fund ETF | $94.427B | 0.6% | 0.03% | ETF | No |

| AGG | iShares Core US Aggregate Bond ETF | $91.897B | 0.5% | 0.03% | ETF | No |

| SPAB | SPDR Portfolio Aggregate Bond ETF | $6.674B | 0.5% | 0.03% | ETF | No |

| VGIT | Vanguard Intermediate-Term Treasury Index Fd ETF | $13.805B | 0.3% | 0.04% | ETF | No |

| IEF | iShares 7-10 Year Treasury Bond ETF | $29.115B | 0.2% | 0.15% | ETF | No |

| SPTI | SPDR Portfolio Intermediate Term Treasury ETF | $4.177B | 0.1% | 0.06% | ETF | No |

| UTEN | US Treasury 10 Year Note ETF | $35.1M | -0.3% | 0.15% | ETF | Yes |

The key thing to remember is that a wide variety of investment-grade bonds could now be a hedge for portfolios. Investors have plenty of choice to build out their portfolios for ballast.

The Bottom Line

Bonds have long been a top choice for investors looking to find a hedge against stock market risk. However, in recent times correlations have shifted to be more in sync. Given Blackrock’s recent research, bonds returning to negative correlations with stocks could signal that bonds can be used as a hedge once again.

1 Blackrock.com (May 2023). Banks wobble and bonds are back to being a Hedge