These are interesting times for bond investors. Thanks to the recent declines in prices and the Fed’s path of tightening, yields haven’t been this juicy in years. Looking across the fixed income landscape, there’s a lot of choice these days to build a bond portfolio. The best value could be a combo meal.

A core-short combo, that is.

According to the analysts at Lord Abbett, a combination of core bonds and short-term securities could be the best for finding yield and duration protection. The best part is that adding the combination is easy. For investors, ordering a core-short combo could be a wonderful portfolio solution.

Issues With the 'Building Blocks' of Bond Portfolios

Core bonds, or intermediate bonds, are seen as the main building blocks when it comes to bond portfolios. These bonds represent the middle ground of duration—usually five to 10 years—and feature investment-grade ratings. Core bonds cover a wide range of securities, including U.S. government, agency, corporate, and mortgage-backed securities. Tax-free municipal bonds are excluded from this definition of core bonds. So, we’re looking at bonds issued by corporations like Coca-Cola (KO), the U.S. Treasury, and Fannie Mae.

The uber-popular Bloomberg U.S. Aggregate Bond Index plays right into the sweet spot of this definition and is seen as a major core bond benchmark.

The problem with core bonds is that they are affected by changes in interest rates. That’s exactly what’s been going on over the last year or so. As inflation has surged and is now being stubborn, the Federal Reserve has continued to increase rates. For longer-termed bonds like those in the core category, this has resulted in negative total returns. Last year, the Agg fell by over 13%, and this year the index has been treading water.

Short-term Bonds to the Rescue

The win for investors is that because of the recent declines and interest rate hikes, core bonds are now offering some of the juiciest yields in years. Right now, the Bloomberg U.S. Aggregate Bond Index has a yield to worst of 4.40%. That’s a very attractive entry point for investors looking for income.

The problem remains the Fed.

With inflation still running a bit high and above the central bank’s 2% target, more rate hikes could be on the horizon. During the latest FOMC meeting minutes and last press conference, the central bank basically outlined the potential for more increases. For investors looking at core bonds, bond prices will drop in response to those hikes and potentially create losses.

So, what to do?

According to Lord Abbett, the answer may lie within adding short-term bonds to a portfolio as well. By moving down the duration ladder, investors are able to pick up strong current yields. However, short-term bonds have the advantage over cash when the Fed pauses or cuts. Here, short-term bonds ‘feel’ the cuts less and investors won’t be forced to sell cash and invest it into bonds that are now yielding less.

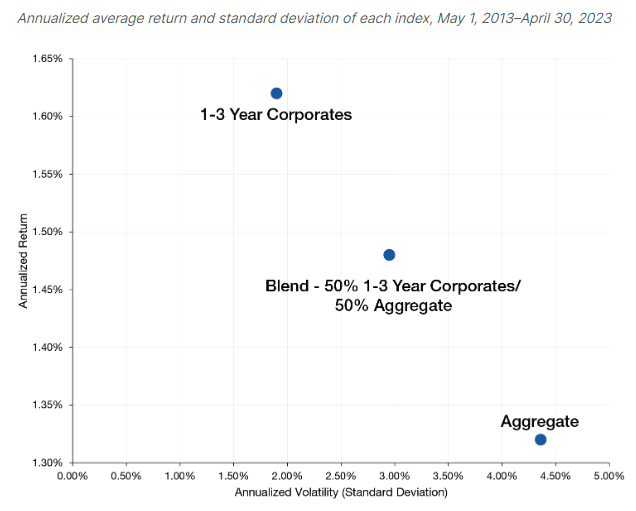

The best part is the combination of core and short-term bonds produce great returns and much lower volatility. Core bonds tend to rise in price after the Fed pauses or cuts, while short-term bonds are steady. According to the investment manager, a 50-50 blend of intermediate-term and short-term bonds greatly reduced the interest rate risk of a core bond-only portfolio while providing attractive levels of return.

This chart from Lord Abbett of the last 10 years underscores the attractive yield and return.

Source: Lord Abbett

Going forward, the combination is a prime way to play all the uncertainty with the Fed. If the Fed keeps raising rates, the high yields on the short-term bonds will protect losses on the core side. If the Fed cuts, the core side will see price increases, while the short-term side is likely to remain steady.

Ultimately, the combo is the top play for investors today, offering income and protection.

Ordering a Core-Short Combo

Given the environment, investors may want to take Lord Abbett’s advice and order a core-short combo for their portfolio. The investment manager suggests going 50/50 with the allocation as this yields the best benefits for any market environment and path the Fed may take.

Luckily, there are plenty of ways to add both bond varieties via mutual funds and ETFs. This includes both passive and active management styles. For example, pairing the iShares Core U.S. Aggregate Bond ETF and BlackRock Short Maturity Bond ETF could be all you need. Likewise, the Lord Abbett sponsored Core Plus Bond Fund and * Short Duration Income Fund* can be used for an active approach.

Core Bond ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| BND | Vanguard Total Bond Market Index Fund ETF | $95.6B | -0.6% | 0.03% | ETF | No |

| JCBUX | JPMorgan Core Bond Fund Class R6 | $33.7B | -0.6% | 0.34% | MF | Yes |

| AGG | iShares Core US Aggregate Bond ETF | $94.1B | -0.8% | 0.03% | ETF | No |

| SPAB | SPDR Portfolio Aggregate Bond ETF | $6.63B | -0.8% | 0.03% | ETF | No |

| LAPLX | Lord Abbett Core Plus Bond Fund Class A | $133.7M | -0.9% | 0.68% | MF | Yes |

Short-term Bond ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| NEAR | BlackRock Short Maturity Bond ETF | $3.71B | 0.8% | 0.25% | ETF | Yes |

| BSV | Vanguard Short-Term Bond Index Fund ETF | $34B | 0.3% | 0.04% | ETF | No |

| OGLVX | JPMorgan Short Duration Bond Fund Class A | $8.55B | 0.3% | 0.81% | MF | Yes |

| VUSB | Vanguard Ultra-Short Bond ETF | $3.386B | 0.1% | 0.1% | ETF | No |

| LALDX | Lord Abbett Short Duration Income Fund Class A | $56.9B | -0.5% | 0.58% | MF | Yes |

Keep in mind that Lord Abbett’s study used the ICE BofA U.S. Corporate 1-3 Year Index and Bloomberg U.S. Aggregate Bond Index to produce its results. However, any combination of short-term bond funds and the Agg should help to create the desired effect of balancing duration risk and current income needs. Active management may have an edge given the bond sector’s eccentricities.

The Bottom Line

Intermediate/core bonds are offering some of the juiciest yields in years. However, there is a fair amount of duration risk. For investors, dialing back that risk with a dose of short-term bonds could be a great idea. According to Lord Abbett, the combination produces the best of both worlds, offering high income for today, the potential for gains, as well as downside protection if the Fed keeps raising rates. Adding the combination is easy either with ETFs or mutual funds, active or passive.