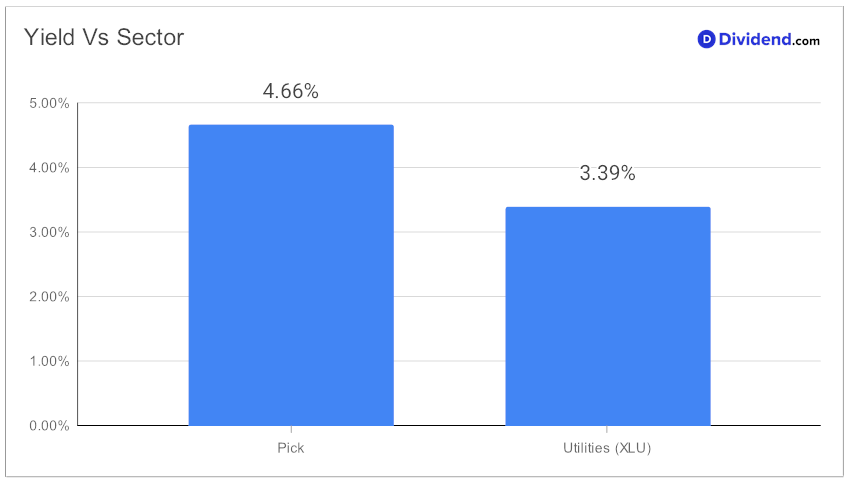

In the landscape of dividend investing, a standout Integrated Utilities stock has recently been added to the acclaimed Best Sector Dividend Stocks model portfolio. This large-cap stock is distinguished by its impressive dividend yield, which at 4.66%, surpasses the industry average of 4.1%. This robust yield places it comfortably in the top 40% of its class, making it an attractive option for balanced dividend investors.

Notably, the stock boasts a 21-year track record of consistent dividend increases, a feat that ranks it in the elite top 10% of dividend stocks. This consistency signals not just stability but also the potential for future growth, a critical factor for discerning investors. The next payout, marked by a 5.8% increase to $0.780 per share, is scheduled post its December 28 ex-dividend date, with a payment date set for January 31.

This inclusion in the model portfolio follows a rigorous recommendation process, which aims for an optimal blend of yield, dividend safety, returns potential, and risk, specifically among Utilities dividend stocks. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 2, 2023.

For investors seeking deeper insights, an in-depth stock analysis will follow, providing a comprehensive understanding of this stock’s potential in a balanced investment strategy.