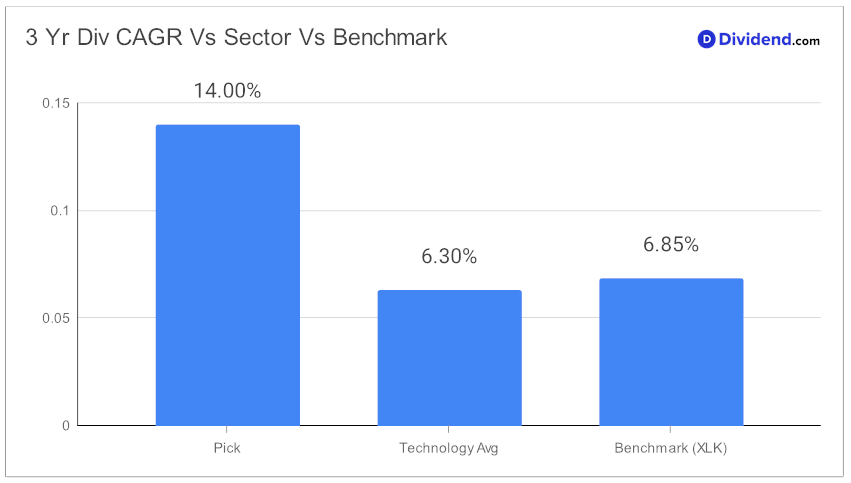

In the dynamic world of dividend investing, a standout tech services stock reaffirms its position within a meticulously curated model portfolio for best sector dividend stocks. This large-cap entity, recognized for its robust dividend track record, boasts an impressive 40+ year streak of dividend increases, positioning it in the upper echelon of dividend-paying stocks. Its commitment to shareholder returns is further underscored by a 14% three-year dividend per share compound annual growth rate (CAGR), showcasing its growth potential and reliability.

As we navigate through the year, the stock has already outperformed, delivering a 7% return, surpassing both the S&P 500’s 3% and its own industry’s 4%. This performance speaks volumes about its resilience and appeal to balanced dividend investors seeking a blend of yield, safety, and growth potential.

Looking ahead, investors can anticipate the next payout, maintaining an unchanged qualified distribution of $1.400 per share, set to go ex-dividend on March 7. This upcoming payout not only exemplifies the company’s consistent return to shareholders but also serves as a key focus in our in-depth analysis. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on October 26, 2023.

Dive deeper with us as we explore the strategic nuances behind this investment choice, providing a comprehensive understanding of its place within a well-rounded technology dividend portfolio.