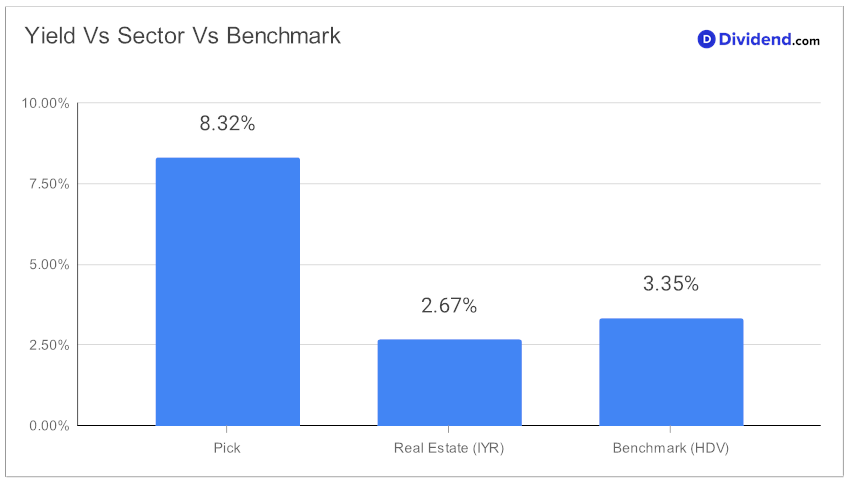

In the realm of monthly dividend investing, securing reliable and attractive returns remains paramount. Amidst this landscape, a well-covered mid-cap eREIT stands out, reaffirming its place in a model portfolio curated for discerning monthly dividend investors. With a forward dividend yield of 8.32%, this entity notably surpasses the industry average of 5.8%, placing it within the top 20% of high-yield dividend stocks. However, potential investors should maintain vigilance against dividend traps, a common pitfall within high-yield scenarios.

Attention is also drawn to the immediate financial opportunity presented by the next payout. Investors should note the upcoming unchanged non-qualified dividend of $0.285 per share, scheduled to go ex-dividend next Monday, April 29. This consistency in payout reflects a strategic emphasis on dividend safety and yield attractiveness, vital components for those prioritizing steady income streams.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 29 Feb, 2024. In its 2023 fourth-quarter and year-end earnings call, entertainment and leisure property focused REIT highlighted its strong earnings growth and strategic investments, particularly noting a significant recovery in its theatre portfolio. Despite the challenges, including the impact of industry-wide strikes that disrupted box office revenues, the company reported a 20% increase in North American box office revenues compared to the previous year, demonstrating resilience and operational efficiency.

The management emphasized a future outlook focused on leveraging strengths, disciplined capital deployment, and diversification, including a 3.6% increase in the monthly dividend to common shareholders. Looking ahead, the company outlined plans for growth in percentage rents and mortgage and other financing income, with a guided Funds From Operations (FFO) per share for 2024, indicating a healthy financial outlook and commitment to delivering strong returns to shareholders.

The detailed analysis that follows will delve deeper into the metrics that affirm this eREIT’s standing in the portfolio—balancing dividend safety with returns potential and risk. This evaluation not only underscores the current yield’s allure but also equips investors with the insights needed to make informed decisions, aligning financial goals with tangible outcomes in monthly dividend investing.