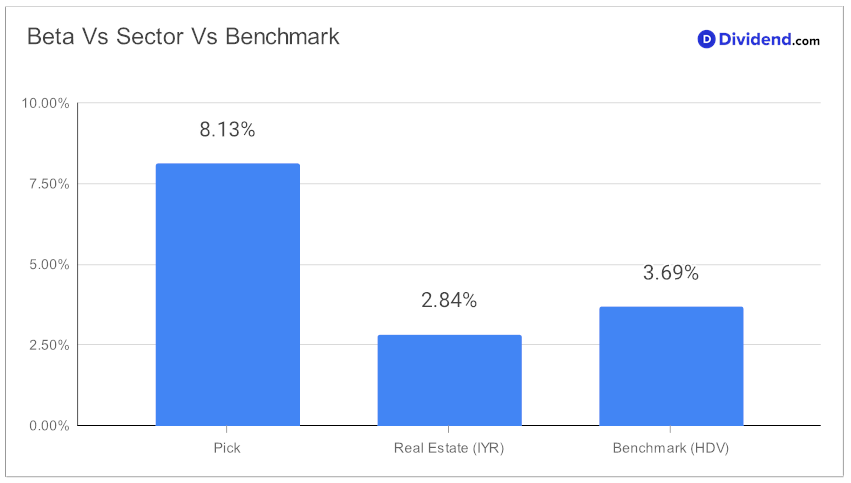

In the world of monthly dividend investing, identifying standout opportunities is key for those seeking to optimize their income streams. One such opportunity presents itself in a mid-cap eREIT that not only offers an enticing forward dividend yield of 8.13%, but also ranks impressively in the top 20% of high-yield dividend stocks. This yield significantly surpasses the industry average of 5.7%, highlighting its potential for monthly dividend investors. Moreover, with a three-year dividend compound annual growth rate (CAGR) of 31%, it stands out amongst its peers for growth potential.

However, the high yield comes with cautionary advice to be wary of potential dividend traps, emphasizing the importance of thorough analysis for dividend safety. Investors will find interest in the upcoming payout of $0.285 per share, which is scheduled to go ex-dividend next Wednesday, March 27. This positions the eREIT as a potentially lucrative holding for those focused on monthly returns.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 29 Feb, 2024. In its 2023 fourth-quarter and year-end earnings call, entertainment and leisure property focused REIT highlighted its strong earnings growth and strategic investments, particularly noting a significant recovery in its theatre portfolio. Despite the challenges, including the impact of industry-wide strikes that disrupted box office revenues, the company reported a 20% increase in North American box office revenues compared to the previous year, demonstrating resilience and operational efficiency.

The management emphasized a future outlook focused on leveraging strengths, disciplined capital deployment, and diversification, including a 3.6% increase in the monthly dividend to common shareholders. Looking ahead, the company outlined plans for growth in percentage rents and mortgage and other financing income, with a guided Funds From Operations (FFO) per share for 2024, indicating a healthy financial outlook and commitment to delivering strong returns to shareholders.

Our in-depth analysis delves further into the aspects of yield attractiveness, dividend safety, and the balance between return potential and risk, catering exclusively to monthly dividend payers. This comprehensive approach ensures investors are well-informed, highlighting how this particular eREIT could be a valuable addition to a monthly dividend-focused portfolio.