In the landscape of high dividend investing, a well-covered large-cap entity within the energy sector emerges as a compelling highlight in our latest model portfolio review. With a forward dividend yield of 7.32%, this investment stands out, surpassing the industry average of 6.5% and placing it in the elite top 20% of high-yield stocks. However, savvy investors know the importance of vigilance against dividend traps, making this opportunity particularly noteworthy due to its 20+ year track record of dividend increases—a testament to its stability and promise for future growth, positioning it in the top echelon of dividend stocks.

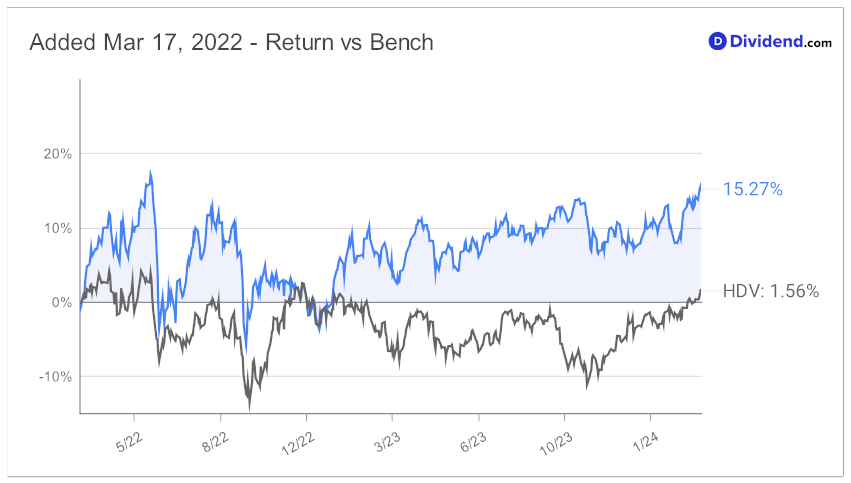

Year-to-date, this stock has outperformed, delivering an 8% return against the broader market’s performance, and showcasing its resilience and strategic positioning within the energy sector. Additionally, since making it to this portfolio back in March 2022, the stock has outperformed the benchmark on a consistant basis.

The upcoming payout, an estimated $0.515 per share on or around April 5, further underscores the timely appeal of this investment.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 2, 2024. The energy infrastructure company demonstrated robust financial and operational performance in 2023, navigating volatile commodity markets to achieve record-breaking results. Generating $7.6 billion in distributable cash flow and retaining $3.2 billion, the company set multiple operational and financial records, underpinned by strong supply and demand fundamentals across key basins.

With $6.8 billion in major organic projects underway, aiming to complete $1.1 billion worth in 2024, the entity is poised for strategic growth. The company’s outlook underscores its resilience and strategic positioning to capitalize on future opportunities, promising for investors seeking stability and growth in the energy sector.

Our recommendation process, honing in on Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Risk, underscores our commitment to uncovering robust dividend opportunities. Stay tuned for our in-depth analysis, where we dive deeper into this standout performer’s fundamentals and future prospects.