In the landscape of dividend growth investing, finding a solid performer with a track record of reliability and promising future prospects is akin to discovering gold. Among such rare finds, a well-covered large-cap eREIT has recently been reaffirmed as a staple in the esteemed Best Dividend Growth Stocks model portfolio. Boasting a forward dividend yield of 4.34%, this eREIT not only offers a yield that stands out in the top 40% of dividend stocks but also surpasses industry expectations with a lower than average yield, signaling its premium quality and stability.

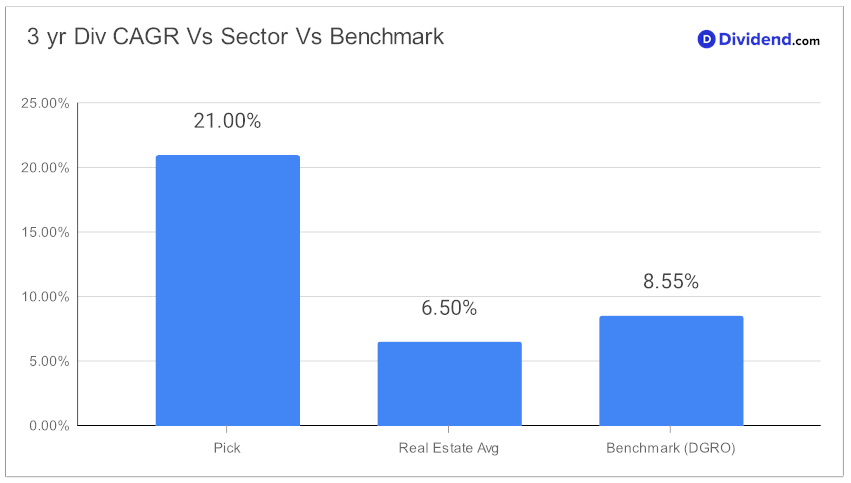

The entity prides itself on a commendable 15-year streak of dividend increases, placing it in the top 10% for consistency among dividend stocks, with anticipated continuations of this trend. Its dividend growth rate over the past three years further cements its position in the top echelon, showcasing a 21% CAGR. Moreover, with a beta of 0.79, it presents an appealing diversification option, demonstrating minimal correlation with broader equity market movements.

Investors will be keen to note the next scheduled payout, maintaining an unchanged rate of $1.470 per share, set to go ex-dividend this Friday, April 12. This key detail, alongside an in-depth analysis of the stock’s performance and potential, forms the cornerstone of a strategic investment approach prioritizing return potential, dividend safety, and to a lesser extent, returns risk and yield attractiveness.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 09 Feb, 2024. The REIT specializing in apartment housing reported exceeding expectations in its recent quarterly earnings, highlighting resilience amidst challenges such as increased new supply and a seasonal slowdown in leasing activity. Management noted steady demand for apartment housing driven by stable employment, positive migration trends, and a preference for renting. They expressed optimism for improved lease pricing and revenue performance in the near future, supported by moderating supply pressures. Celebrating a consistent history of delivering shareholder returns, including regular quarterly dividends, the company underscored its strategic financial management and commitment to shareholder value.

The future outlook remains positive, with strategic acquisitions and developments poised to enhance growth within the competitive apartment focused REIT space.

Join us as we delve into the comprehensive analysis that underscores why this eREIT continues to be a linchpin in the portfolios of discerning dividend growth investors.